eInvoice APIs

Generate eInvoice through your existing Software/ERP in just few clicks with FREE eInvoice DLLs & LIBs.

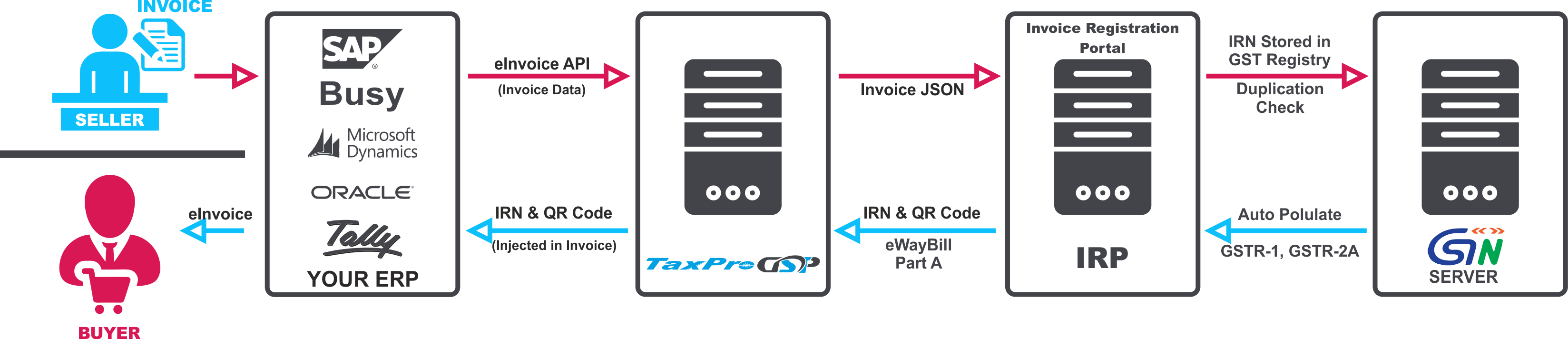

How eInvoice works?

Few, from long and prestigious list of our API users.

Generate eInvoice from your existing software

Also, eInvoice integration is trivial for ASPs / ERP Developers using eInvoice APIs and Free Java Library or .Net Core or .Net DLLs offered FREE by TaxProGSP.

No onboarding Charges! Free Integration support!!

Any ERP on Any Platform

Easy & Quick Integration

No need to call AuthToken API. eInvoice libraries internally checks for valid AuthToken, and refreshesh AuthToken internally and transperantly to user. Just couple of hours of your time, and you are ready to go. Source code of Integration projects available for Download.

White labelled Panel

White labelled or own labelled eInvoice API url and CRM to manage number of Resellers, Sub-resellers, and clients from single ASP login.<br> Web application to manage pre-paid ASP accounts, API recharges, API uses summary.

On-call Expert Support

Our dedicated support and integration experts are available throughout the process of Integration and further ongoing support to help address functional and technical queries in day to day use TaxPro GSP Google Group to Notify updates.

Get our FREE Java or .Net DLL/Library today!

eInvoicing Functions Available as API

Post APIs

- Authenticate

- Generate IRN

- Cancel IRN

Get APIs

- Get eInvoice by IRN

- Get GSTIN Details

- System Check

eInvoice FAQs

GSP FAQs:

Once you register as ASP under TaxPro GSP, which is completely free, you may use TaxPro GSP urls to access eInvoice API. Our GSP servers will automatically inject GSP ClientID to your request before forwarding the same to IRP.

TaxPro GSP will completely eliminate the role of JSON Files & multiple visits to the IRP, as it will allow you to generate & perform all the other eInvoice operations within your ERP itself.

TaxPro GSP acts as a link between the IRP & the ERP through it’s eInvoice APIs thus any actions taken on the ERP are directly updated to the IRP without having to update them manually.TaxPro GSP eInvoice APIs and Free Java Library or .Net DLLs are the best solution for large enterprises who are notified for eInvoicing. TaxPro GSP is capable of handling the high volumes pressure. Its Infrastructure & High-Availability makes it the to go eInvoice solution for large businesses.

TaxPro GSP efficiently helps business in saving manpower, energy, time & cost, as business doesn’t have to make any major change to existing billing system. The bulk operation & the shortened process will help large enterprises in achieving their agenda more effectively and economically.

Can eInvoices be generated, validated and IRN & QR Codes created for those, from existing Accounting/Billing/ERP software, through TaxPro GSP eInvoice integration?

Yes, with the TaxPro GSP through its APIs and Free Java Library or .Net DLLs integration with your existing Accounting/Billing/ERP software can generate and validate eInvoices and create IRN & QR Codes for those.

You can also edit, preview, print, and cancel the eInvoices within the existing Accounting/Billing/ERP software, without having to visit the IRP.

Yes, TaxPro GSP has facility to perform bulk operations within the existing Accounting/Billing/ERP Software, upon integration. You can now generate, edit, preview, print, validate, create IRN & QR codes, and cancel the eInvoices in bulk within the existing software.

Introduction FAQs:

As per GST Rules, notified class of registered persons or organizations have to prepare invoice by uploading specified particulars of invoice on Invoice Registration Portal (IRP) and obtain an Invoice Reference Number (IRN).

After following above process, the invoice copy containing the IRN (with QR Code) issued by the notified supplier to buyer is commonly referred to as eInvoice in GST.

Because of the standard schema, eInvoice facilitates exchange of the invoice document (structured invoice data) between a supplier and a buyer in an integrated electronic format.

There is no much difference indeed.

Registered persons or organizations will continue to create their GST invoices on their own Accounting/Billing/ERP Systems as they are currently doing.

Under eInvoicing these invoices generated through the same process as earlier will now be reported to ‘Invoice Registration Portal (IRP)’. On reporting, IRP returns the invoice with a unique ‘Invoice Reference Number (IRN)’ after digitally signing the and adding a QR Code. This process makes your current Invoice an eInvoice, the same eInvoice can be issued to the receiver (along with QR Code).

For reporting the Invoices generated through your existing system to the IRP and get the IRN & QR Code you need to use the eInvoice API from TaxPro GSP.

For Registered persons or organizations whose aggregate turnover (based on PAN) in any preceding financial year from 2017-18 onwards, is more than prescribed limit (as per relevant notification), eInvoicing is mandatory.

eInvoice has many advantages for businesses such as auto reporting of invoices into GST return, auto generation of eWayBill(where required).

eInvoicing will also facilitate standardization leading to reduction of disputes among transacting parties, improve payment cycles, reduction of processing costs and thereby greatly improving overall business efficiency.

Businesses will continue to issue invoices as they are doing now. Necessary changes for eInvoicing requirement (to enable reporting of invoices to IRP and obtain IRN), can be easily done to their existing Accounting/Billing/ERP systems through adding eInvoice APIs and Free Java Library or .Net DLLs offered FREE by TaxPro GSP.

TaxPro GSP do not charge any Onboarding Charges! And provides Free Integration support!!

Ask your ERP/Accounting/Billing Software providers to get in touch with TaxPro GSP to have seamless integration of eInvoicing.

Applicability FAQs:

When issued by notified class of person or organization (to registered persons or organization (B2B) or for the purpose of Exports) are currently covered under eInvoice.

Though documents like Debit Note and Credit Note are also covered, for ease of reference and understanding, the system is referred as eInvoicing.Supplies to registered persons or organization (B2B), Supplies to SEZs (with/without payment), Exports (with/without payment), Deemed Exports, by notified class of person or organization are currently covered under eInvoice.

No. In those cases, a bill of supply is issued and not a tax invoice.

eInvoicing by notified persons or organization is mandated for supply of goods or services or both to a registered person or organization (B2B).

Thus, where the Government Department doesn’t have any registration under GST (i.e. not a ‘registered person’), eInvoicing doesn’t arise.

However, where the Govt. department is having a GSTIN (as entity supplying goods/services/ deducting TDS), the same has to be mentioned as recipient GSTIN in the eInvoice.

Yes. eInvoicing by notified persons or organization is mandated for supply of goods or services or both to a registered person or organization.

As per Section 25(4) of CGST/SGST Act, “A person who has obtained or is required to obtain more than one registration, whether in one State or Union territory or more than one State or Union territory shall, in respect of each such registration, be treated as distinct persons for the purposes of this Act.”

Special Economic Zone Units.

Insurer or a Banking Company or a Financial Institution, including a Nonbanking Financial company.

Goods transport agency supplying services in relation to transportation of goods by road in a goods carriage.

Suppliers of passenger transportation service.

Suppliers of services by way of admission to exhibition of cinematograph films in multiplex screens.

Yes. As per Foreign Trade Policy, Free Trade & Warehousing Zones (FTWZ) are only a special category of Special Economic Zones, with a focus on trading and warehousing.

Yes, eInvoicing is applicable for supplies by notified persons or organization to SEZs. As per terms of Notification (Central Tax) 61/2020 dated 30/07/2020, only SEZ Units and not their suppliers are exempt from issuing eInvoice.

An entity having a SEZ unit and a regular DTA unit under same same PAN but different GSTIN. The aggregate total turnover of the entity (PAN) is more than notified limit (considering both the GSTINs). However, turnover of the regular DTA unit is below notified limit. In this scenario, as SEZ unit is exempt from eInvoicing, whether eInvoicing will be applicable to regular DTA Unit?

Yes, because the aggregate turnover of the entity (PAN) in this case is more than notified limit. The eligibility is based on aggregate annual turnover on the common PAN and not separate GSTIN under the PAN.

If the invoice issued by notified person or organization is in respect of supplies made by him but attracting reverse charge under Section 9(3), eInvoicing is applicable.

For example, a taxpayer (say Goods Transport Agency or a Firm of Advocates having aggregate turnover in a FY is more than notified limit) is supplying services to a company (who will be discharging tax liability as recipient under RCM), such invoices have to be reported by the notified person to IRP.

On the other hand, where supplies are received by notified person from (i) an unregistered person (attracting reverse charge under Section 9(4)) or (ii) through import of services, eInvoicing is not applicable.

Invoice Registration Portal (IRP) FAQs:

The Invoice Registration Portals are entities that act as Registrars and operate through a website for assigning Invoice Reference Numbers (IRN) to each invoice/credit note/debit note. The invoice details can be uploaded onto the Invoice Registration Portal using a prescribed mode for the purpose of either generating or validating the Invoice Reference Number (IRN) of the invoice uploaded. Only such invoices with an IRN will be considered valid as eInvoicing.

“The Invoice Registration Portal performs below tasks:

Generation of hash/IRN for invoices:

In case the invoices have been uploaded without hash, the Invoice Registration Portal generates the hash/IRN for those invoices in the prescribed format based on the IRN parameters.

Validation of hash/IRN for invoices:

When the taxpayer generates the hash on their systems, the invoice is uploaded with the hash and the IRN checks if the hash is correct as the parameters.

De-duplication check:

The portal conducts a check of the hash/IRN of invoice for any duplication or repetition by comparing it with information stored in the depository.

Digital Signing of validated invoices:

All the validated invoices gets digitally signed by the Invoice Registration Portal using the private key of the IRP. This digitally signed JSON file is then made available to the supplier.

Generation of QR codes in respect of validated invoices:

Along with digital signature IRP also generates a QR code for each invoice. The same QR code can be used to verify/print the invoice and to have a quick view/access on handheld devices. This feature is especially useful for assessing officers and other stakeholders to verify Invoice details. The QR code includes the following details:

- GSTIN of supplier

- GSTIN of recipient

- Invoice Number

- Invoice Date

- Invoice Value

- Number of line items

- HSN Code of the main item (the line item having the highest taxable value)

- Unique IRN (Invoice Reference Number hash)

Sending the invoice via e-mail:

IRP sends validated invoice to the e-mail address of the seller.

Offline app:

The IRP will also make available an offline app to authenticate the QR code of an invoice offline and view its basic details.

Integration with GST and eWayBill system:

The IRP will share details of the uploaded invoice with the GST system which will allow for automatic updating of GSTR-1 (for the seller). Further, the IRP will also share the details of invoice with the eWayBill system wherever required to make the process of creating eWayBill even simpler and easier.

eInvoicing - Made Easy and Fast with TaxPro GSP

TaxPro is India’s leading GST Suvidha Provider that keeps innovation and taxpayers’ convenience at the forefront. Hence, we bring to you TaxPro GSP, a value-added GST eInvoice portal that can generate, preview, print, create IRN/QR codes, and cancel eInvoices in bulk within existing ERP software, upon integration. A taxpayer can enter invoice details on our eInvoicing portal, which in turn will create JSON files for uploading eInvoices, and then, IRP will authenticate the data. Along with IRN, each invoice is digitally signed and added with a QR code for the collective process of eInvoicing under GST. No need for manual data entry. Integrate TaxPro GSP for bulk eInvoicing operations and file GST returns and generate eWay Bills seamlessly.

Get Started and Connect Your ERP with Our eInvoicing API

- Direct generation of eInvoices and eWay Bill

- Easy integration along with comprehensive technical support

- Managed API for all formats, including JSON, XML, etc.

- Fast and robust technology

- Detect errors and smart user interface

- High-grade encryption and data backup

- Around-the-clock assistance from an expert team

Schedule a free demo!

eInvoicing Software – Compatible with all ERPs

TaxPro GSP is an all-inclusive, scalable, and robust eInvoice API software encompassing free Java library, .Net Core, or .Net DLLs. Our eInvoice APIs will take care of JSON invoice data encryption, digital signing, authentication, validation, and other requirements. It also provides custom image formats and sizes with a high-quality resolution for eInvoice QR code generation. No need to visit multiple times to IRP. You can edit, preview, print, and cancel invoices in bulk within your existing accounting, billing, or ERP software. No matter what platform you use, TaxPro GSP connects with it. It is compatible with most ERPs and ingests data error-free.

- Seamless integration across all ERPs

- Easy upgrades due to tax law changest

- 24/7 in-house technical support and advisory services

- Network and application security

- Historical data backup and storage

- Advanced user access management

Your eInvoicing and Data Security are Our Priority

As per the eInvoicing applicability for businesses with an annual turnover exceeding 5 crores (w.e.f. August 2023), you need to electronically upload all B2B invoices to the portal. TaxPro GSP can be your best aid to generate bulk eInvoices in the required format and upload them to the IRP portal hassle-free. Moreover, it will simplify eInvoice registration under GST, and compliance, reduce reconciliation errors, enable effective functioning of capital performance, and improve business efficiency. It will reduce double efforts as well as manual involvement in tax returns filing and evaluation. We make no compromises when it comes to eInvoice generation and the security of your data. We use enterprise-grade cyber security to ensure compliance and proper management. Our team will ensure the security, availability, confidentiality, and privacy of your data at all times.

Data Validation

Generate eInvoices in bulk and enable auto validation of data to ensure 100% compliance of legacy accuracy and adherence to authority’s regulatory requirements.

Enables Accurate Return Filing

TaxPro GSP identifies minute detail and helps taxpayers to file GST returns with 100% accuracy and precision. It ensures no error slips forward in your GST filing procedure.

On-Call Expert Support

We have a dedicated technical support team available to assist you with eInvoice queries and advisory services. All it takes is a few minutes and you are ready to get started with eInvoice API.