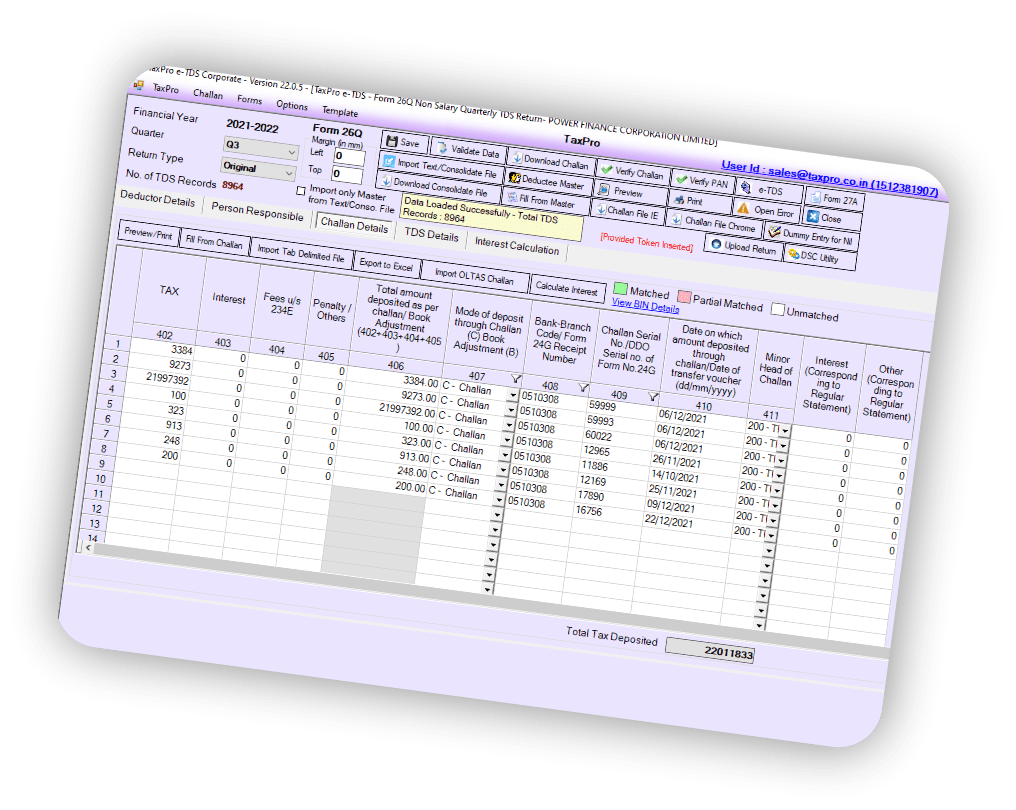

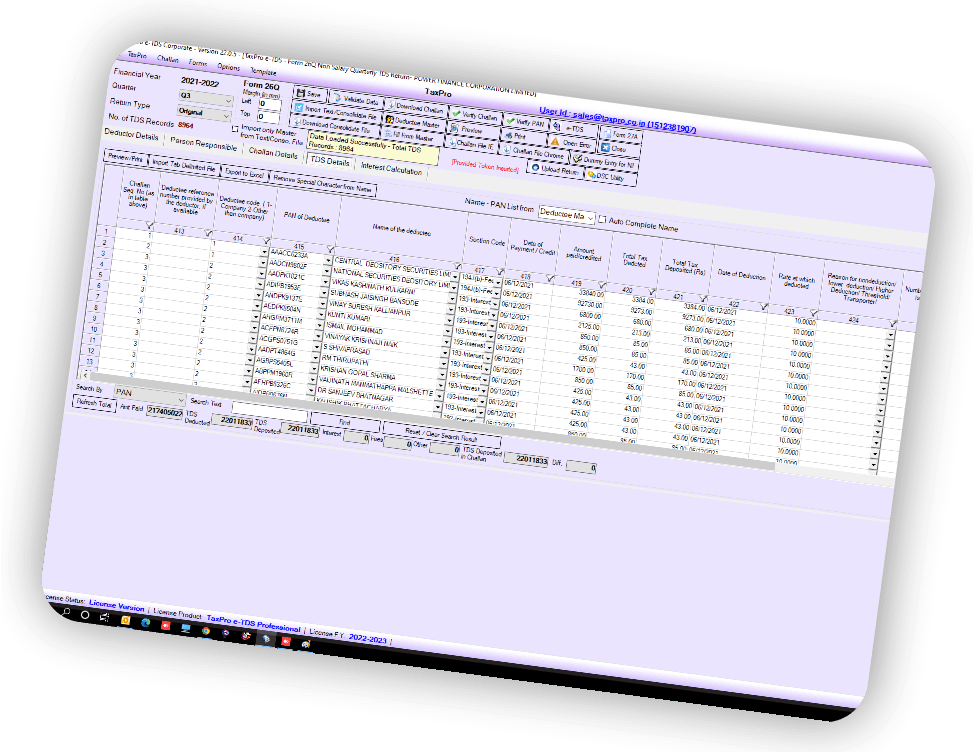

Supports 1.5 millions+

(15 Lakhs+)

of TDS/TCS Transactions.

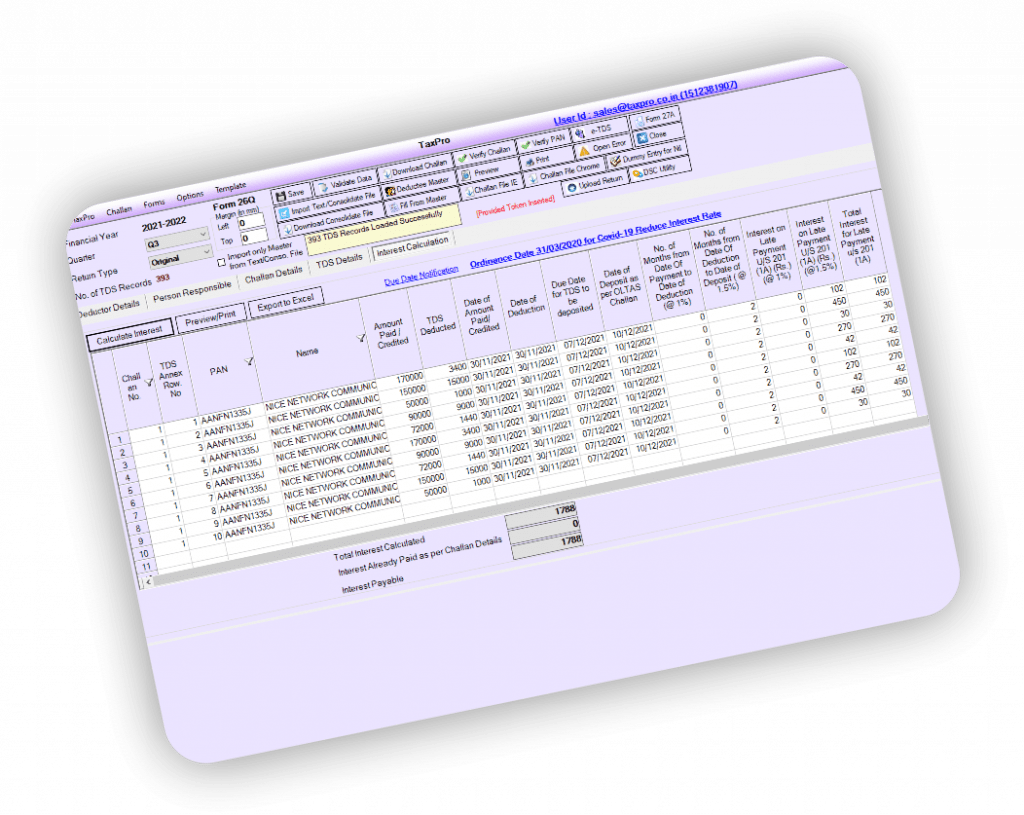

Inbuilt TDS Computation

along with applicable TDS Rate and Interest for Late Payment and Late Deduction

with Validation.

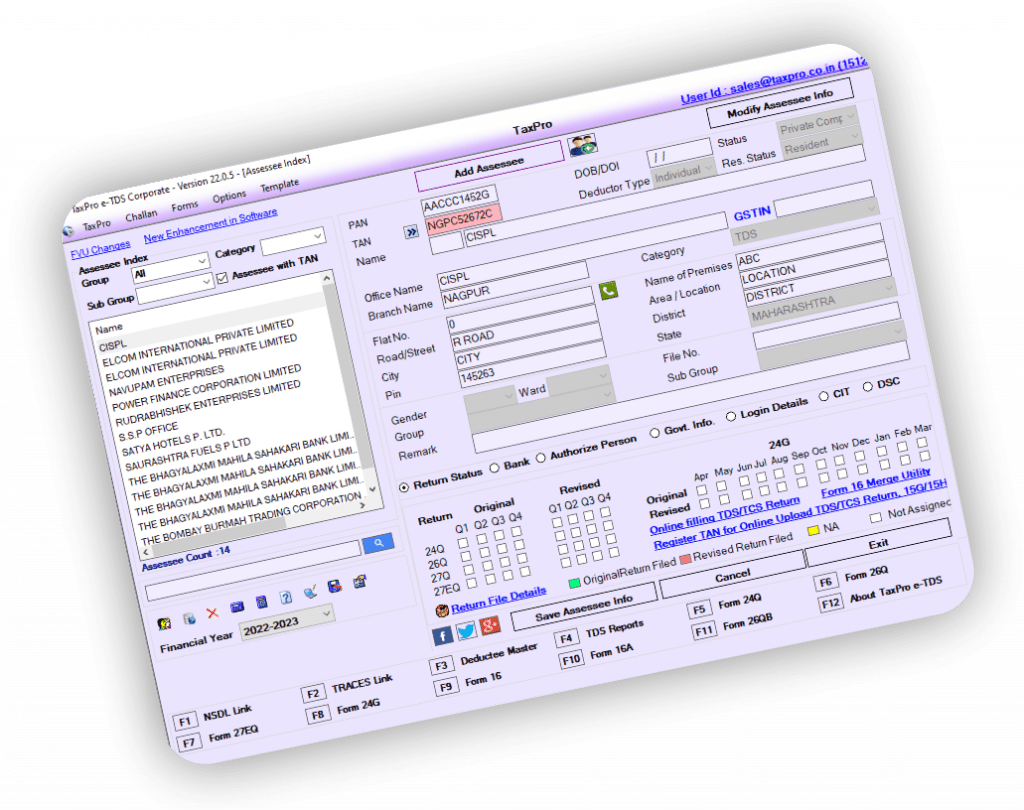

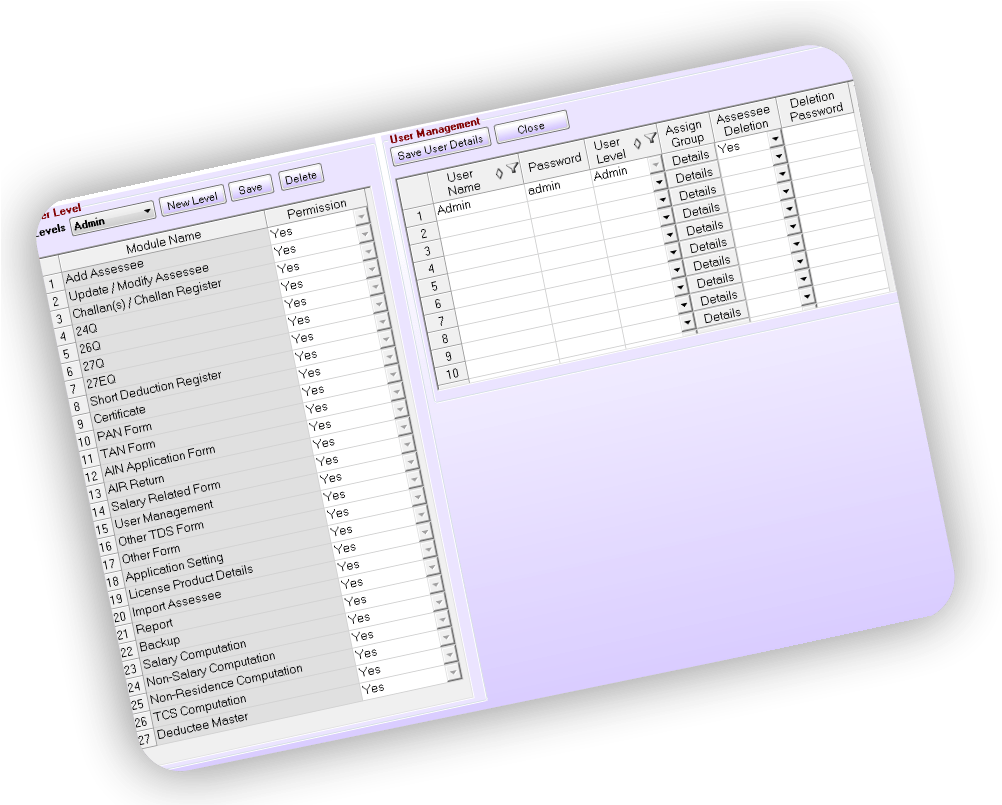

Assessee Dashboard

with innovative presentation

&

unlimited Assessee Support.

Build Assessee Master Data from TDS/TCS Return Text files.

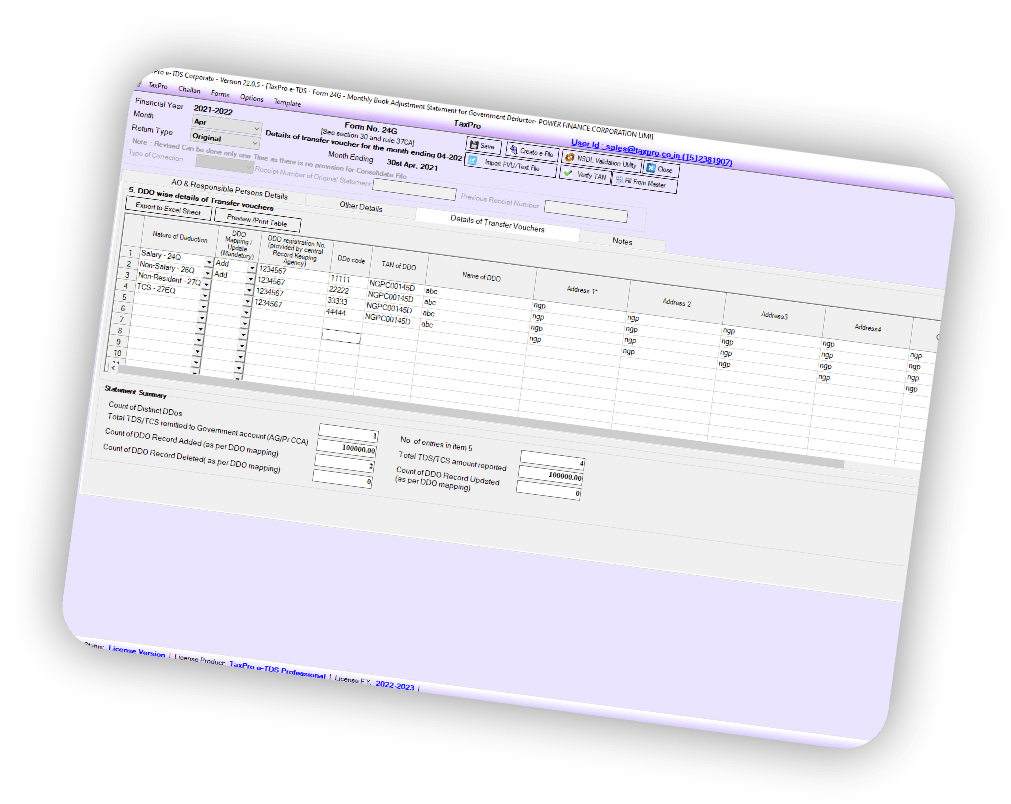

Quarterly TDS/TCS Return

Form 24Q, 26Q, 27EQ & 27Q with inbuilt validation of data.

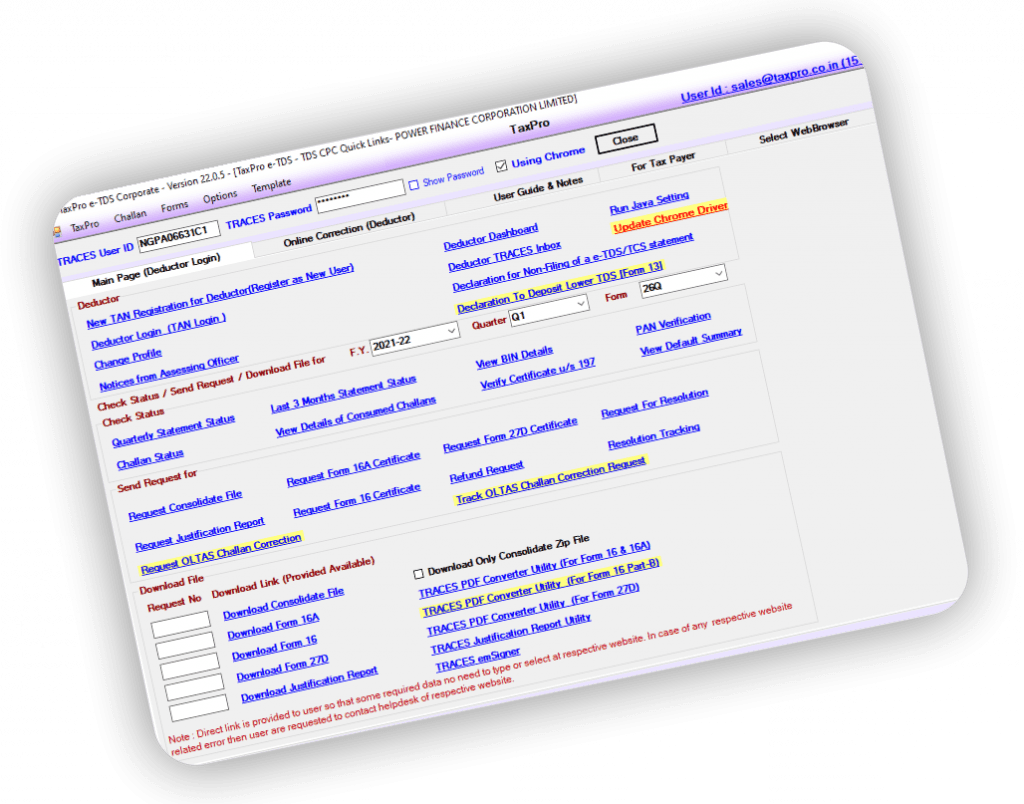

Direct Upload

and Online Correction

of TDS/TCS Returns.

Import TDS/TCS Return

Data from Excel Templates

with inbuilt validation.

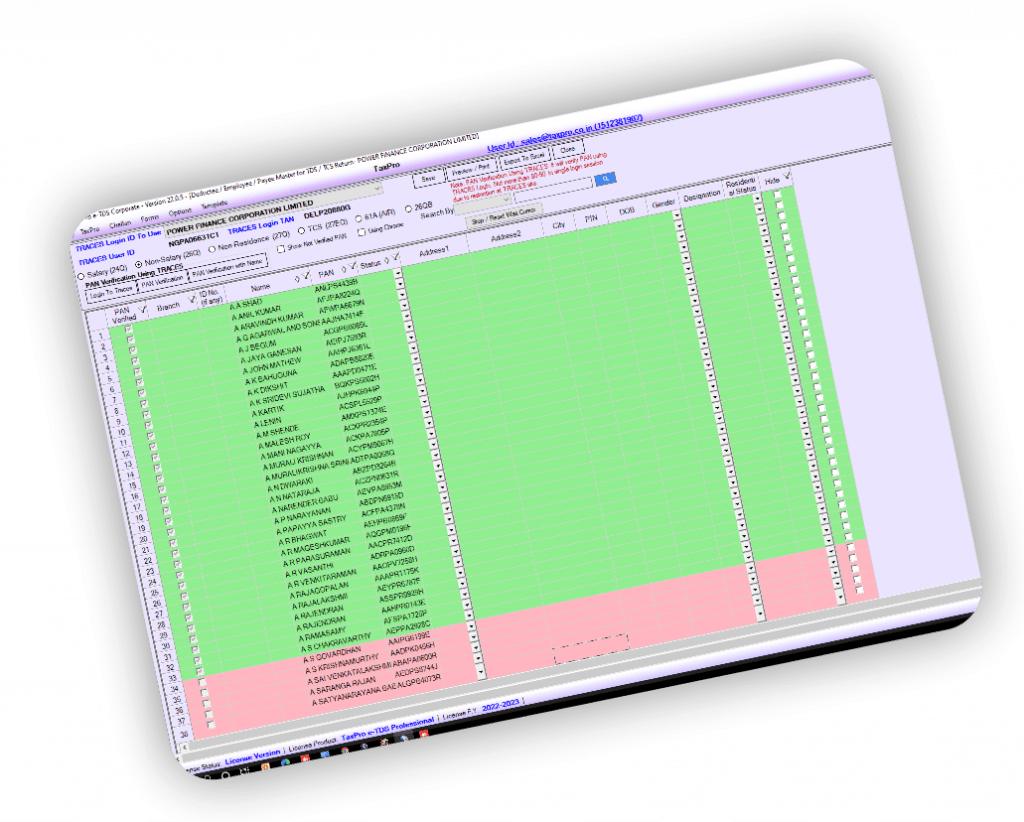

Bulk PAN Verification

for Deductee Master.

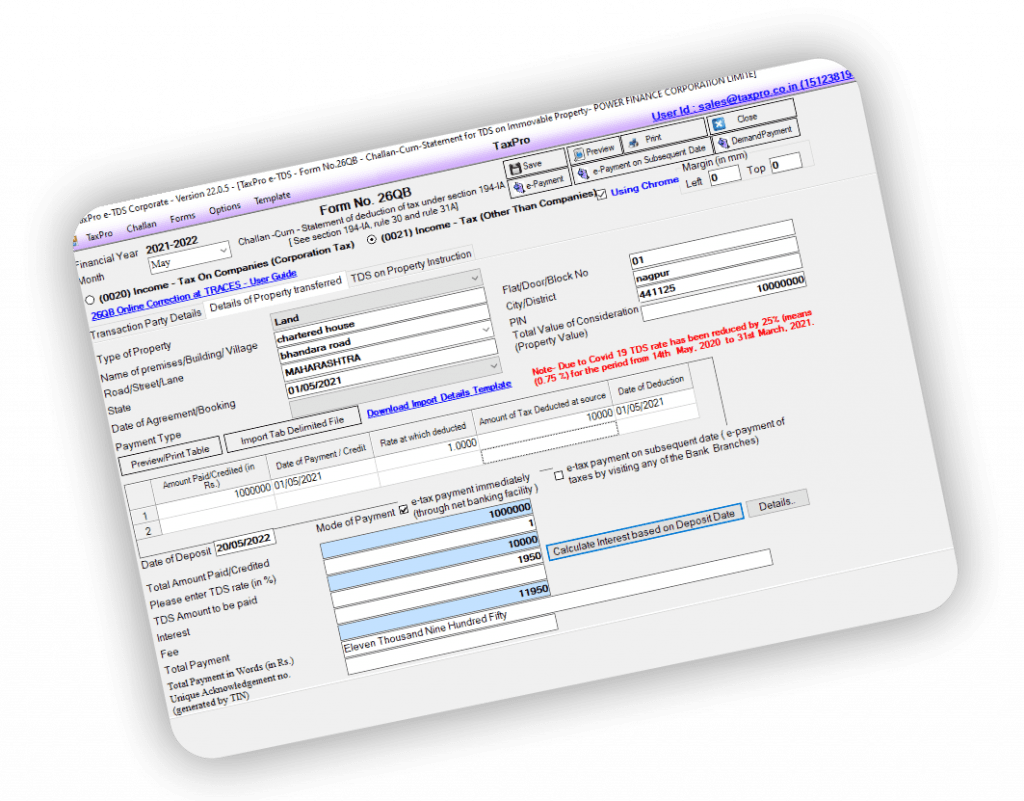

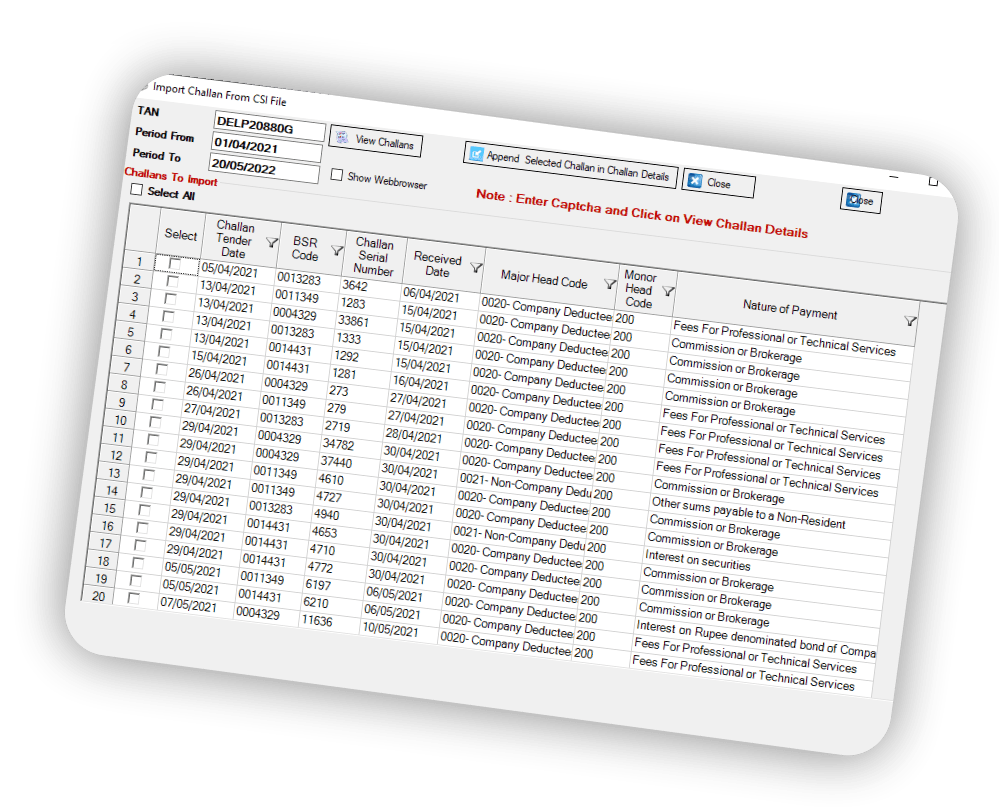

Challans

280/281/282/26QB/26QC…

etc. with ePayment Option.

Bulk Form 16/16A PDF

Generation from Software Data & From TRACES File with Digital Signature Option.

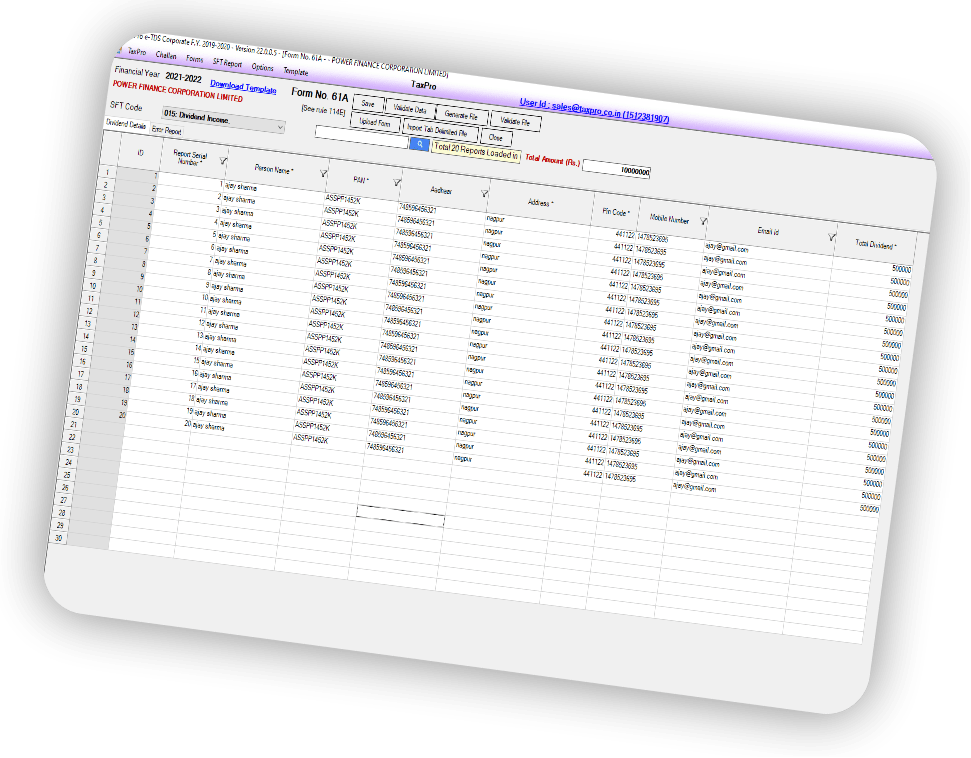

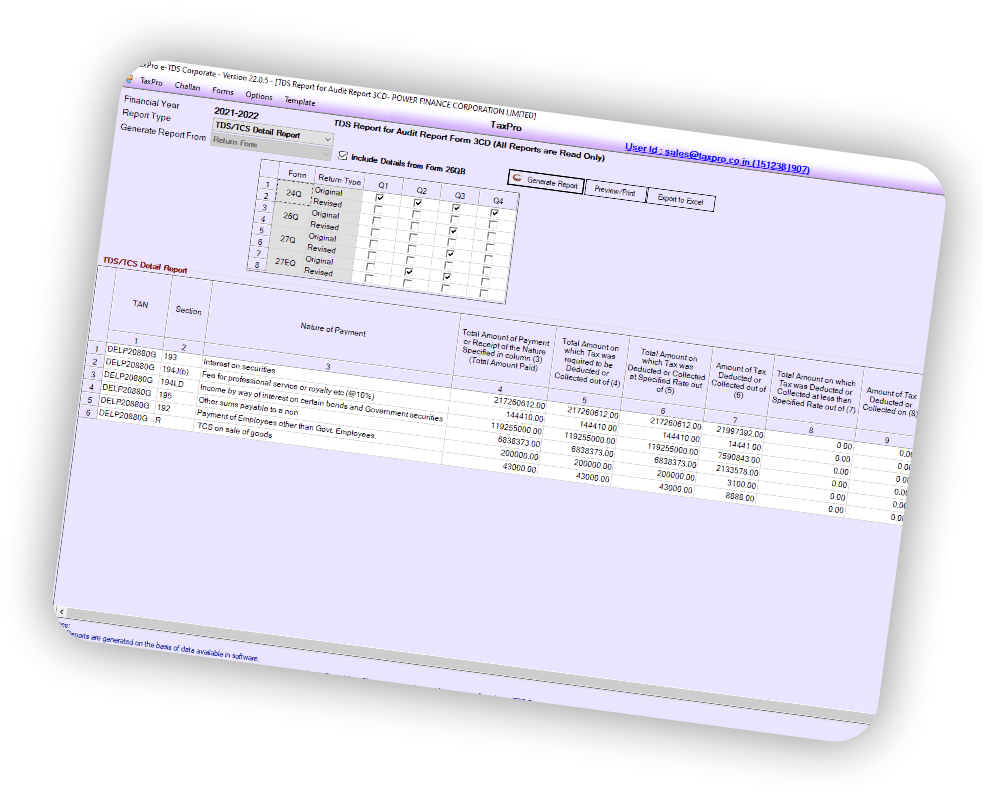

All SFT Return,

15G/H returns,

Other TDS Related Forms and many more.

Compliance check

for section 206AB/206CCA.

Quick Links for TRACES

Deductor Dashboard.

Request TDS Consolidate,

File/16/16A/27D/

Justification

Report, and many more.

Automated SMS Notification to Client option available.

Printable Version.

An ISO 27001 Certified Company

© 2020 Chartered Information Systems Pvt. Ltd. | Privacy Policy | Terms of Use