How an IRN Generation API Can Help Businesses Smooth Their Workflow?

In the fast-changing world of digital taxes today, businesses need to keep up with real-time reporting demands without sacrificing efficiency. With the rollout of e-invoicing under GST in India, getting an Invoice Reference Number (IRN) has become a necessary step for those eligible to pay taxes. While it’s crucial to stay compliant, many businesses find […]

Top Accounting Software Features Every CA Firm Needs

Chartered Accountants are professionals who not only manage financial matters of a business but also ensure compliance and advisory by running through complex accounting and tax matters. The increasing workload demands CAs to move away from the manual operations they previously relied on. In order to remain precise as well as to stay ahead in […]

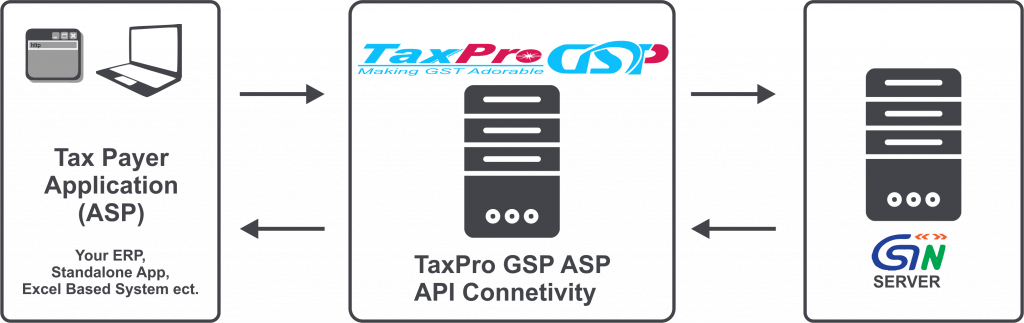

How to Integrate APIs with Your eInvoice Provider?

Are you tired of entering invoicing data into the GST portal manually? Well, you aren’t the only one. With more businesses in India moving toward compulsory eInvoicing, firms are now looking for faster and smarter methods for compliance without repetitive tasks. That’s where API integration can help. By getting your ERP system integrated with an […]

Key Components of a Valid GST Invoice in India

When doing business in India, you must send out a correct GST Invoice. Whether you are selling goods or providing services, if you are registered under GST, you must issue an invoice. An invoice serves as a record of the sale. Still, it is also necessary for tax reporting, as supporting evidence of a claim […]

What Are eInvoicing APIs for eInvoicing Solution & Why ERP Needs Them Now?

Some reports revealed that eInvoicing market reached US$ 187 Million in 2023 and expected to hit US$ 915 Million by 2032. So, businesses are adopting eInvoicing due to its numerous benefits. As of now, businesses with a turnover above ₹5 crore must follow eInvoicing rules set by the government. These rules are not just regulations. […]

Common Misconceptions About eInvoice Applicability

Businesses must ensure compliance with the latest digital invoicing regulations. The eInvoicing is all about ensuring tax compliance, minimizing instances of fraud, and ensuring a much smoother transaction process. Even though it has many benefits, a lot of businesses are still confused about its applicability. Several companies believe that eInvoicing is mandatory for every type […]

Common Mistakes to Avoid When Using an eInvoice Portal

It is a fact that the GST eInvoice Portal has become a vital tool for businesses operating in India. This is because the portal helps them ensure compliance with the Goods and Services Tax (GST) regulations while also helping keep the invoice management process smooth. The GST eInvoice Portal was introduced primarily to improve transparency, […]

Tips and Tricks to Resolve E-Invoicing Integration Errors

When it comes to eInvoicing integration, there are a few challenges and errors that can make your eInvoicing system less effective. The majority of these errors take place because of inadequate information on the eInvoicing systems and providers. Due to this, the chances of financial discrepancies and possible compliance issues can increase hindering the benefits […]

Benefits of Using an eInvoicing Portal for Businesses

In the ever-competitive and fast-paced business world, companies need to keep innovating, improving, and finding ways to streamline operations for maximum efficiency. Invoicing is one of those areas where businesses are behind and could benefit from some improvement especially to gain a competitive edge. Using an eInvoicing Portal minimizes the need for paper. It benefits […]

The Evolution of eInvoicing in India – A New Era of Reform

An electronic invoice is sent over a secure network between a buyer and a seller, digitally. These invoices provide benefits like automated processing, quicker payment processing, and safe transmission. Because it includes encrypted, machine-readable data it is regarded as an effective invoicing method. Furthermore, eInvoicing API simplifies the whole process of creating and sending invoices. […]