Common Misconceptions About eInvoice Applicability

Businesses must ensure compliance with the latest digital invoicing regulations. The eInvoicing is all about ensuring tax compliance, minimizing instances of fraud, and ensuring a much smoother transaction process. Even though it has many benefits, a lot of businesses are still confused about its applicability. Several companies believe that eInvoicing is mandatory for every type […]

Common Mistakes to Avoid When Using an eInvoice Portal

It is a fact that the GST eInvoice Portal has become a vital tool for businesses operating in India. This is because the portal helps them ensure compliance with the Goods and Services Tax (GST) regulations while also helping keep the invoice management process smooth. The GST eInvoice Portal was introduced primarily to improve transparency, […]

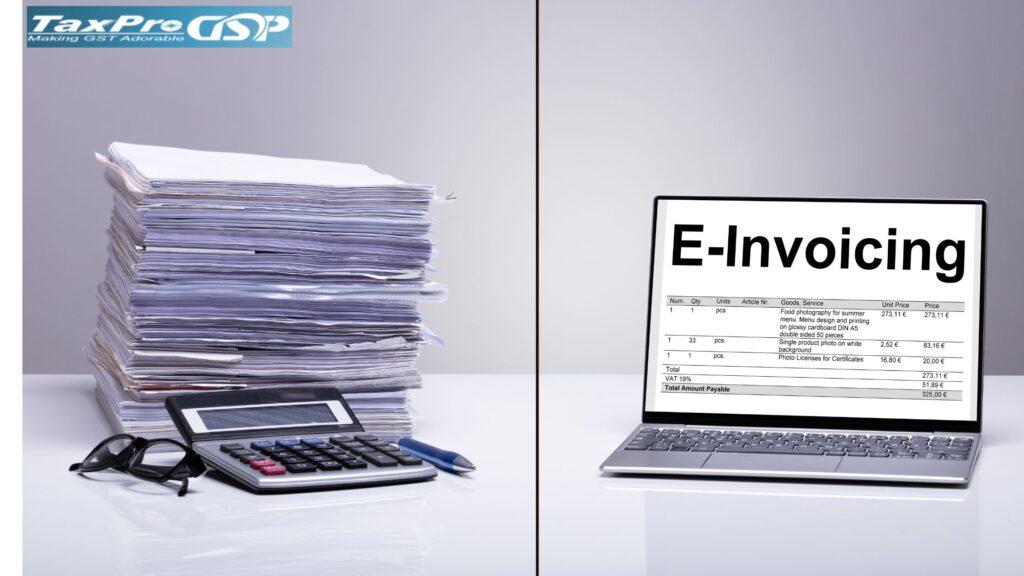

Benefits of Using an eInvoicing Portal for Businesses

In the ever-competitive and fast-paced business world, companies need to keep innovating, improving, and finding ways to streamline operations for maximum efficiency. Invoicing is one of those areas where businesses are behind and could benefit from some improvement especially to gain a competitive edge. Using an eInvoicing Portal minimizes the need for paper. It benefits […]

The Evolution of eInvoicing in India – A New Era of Reform

An electronic invoice is sent over a secure network between a buyer and a seller, digitally. These invoices provide benefits like automated processing, quicker payment processing, and safe transmission. Because it includes encrypted, machine-readable data it is regarded as an effective invoicing method. Furthermore, eInvoicing API simplifies the whole process of creating and sending invoices. […]

What is Invoice Management System (IMS) under GST?

The Goods and Services Tax Network keeps introducing new features to simplify compliance under e-Invoicing. The Invoice Management System is one such feature that has been introduced recently. It aims to help significantly simplify how taxpayers manage invoices. Let us take a look the key features of the Invoice Management System and know how it […]

B2C E-Invoicing: Here Is Everything to Know

The GST Council has recommended eInvoicing for the B2C sector. The intention of introducing eInvoicing for B2C transactions is to improve compliance and reduce tax evasions. B2C invoicing ensures that businesses record all such transactions accurately and report them. A pilot B2C eInvoicing system was introduced by the GST council at its 54th meeting. The […]

7 eInvoicing Mistakes to Avoid For Successful Implementation into Your Business

eInvoicing was implemented in a phased manner. It first became applicable to businesses with annual turnover of INR 500 crores. It was then expanded to businesses with an AATO of INR 100 crores. Eventually, eInvoicing was made essential for businesses with AATO exceeding 5 crores. Most businesses are new to eInvoicing which makes them prone […]

How to Identify and Report a Fake GST Invoice?

The cases of fake GST invoices have witnessed a significant spike in recent times. Fraudsters generate fake GST invoices for several reasons such as tax evasion, fake purchases, money laundering, etc. Scammers are also creating fake GST bills to cheat people. Here are some ways to identify fake GST invoices that can help you avoid […]

What are the Key Challenges with the eInvoicing System?

Implementation of eInvoicing system was authorized by the GST Council in September 2019. As a result, the new compliance reform made its entry in India after successful implementation in over 100 countries globally. The primary purpose of this reform is to make the tax return process easy. But the reform does come with its share […]

E-Invoice Verifiers App: Everything You Need to Know

GSTN recently introduced its user-friendly eInvoice verifier app for efficiently verifying invoices and ensuring a seamless experience for users. The app validates the authenticity of the eInvoice based on the QR code. Users can scan QR codes on their invoices to authenticate the information and compare it with details on the printed invoice. Let us […]