TaxPro TDS Default Notifier¶

- For Checking TDS / TCS FVU FIle before submitting for Default checking

Download TaxPro TDS Default Notifier

TaxPro TDS Default Notifier are as Listed Below¶

Features Summary

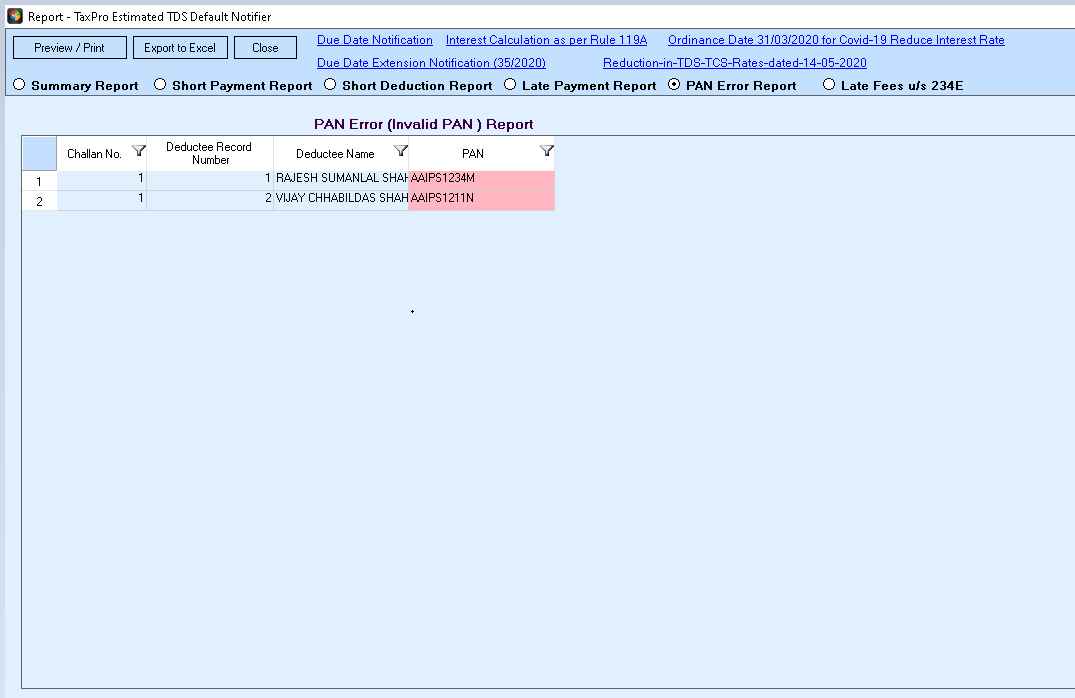

- PAN Verification with Report of Invalid PAN present in TDS/TCS file.

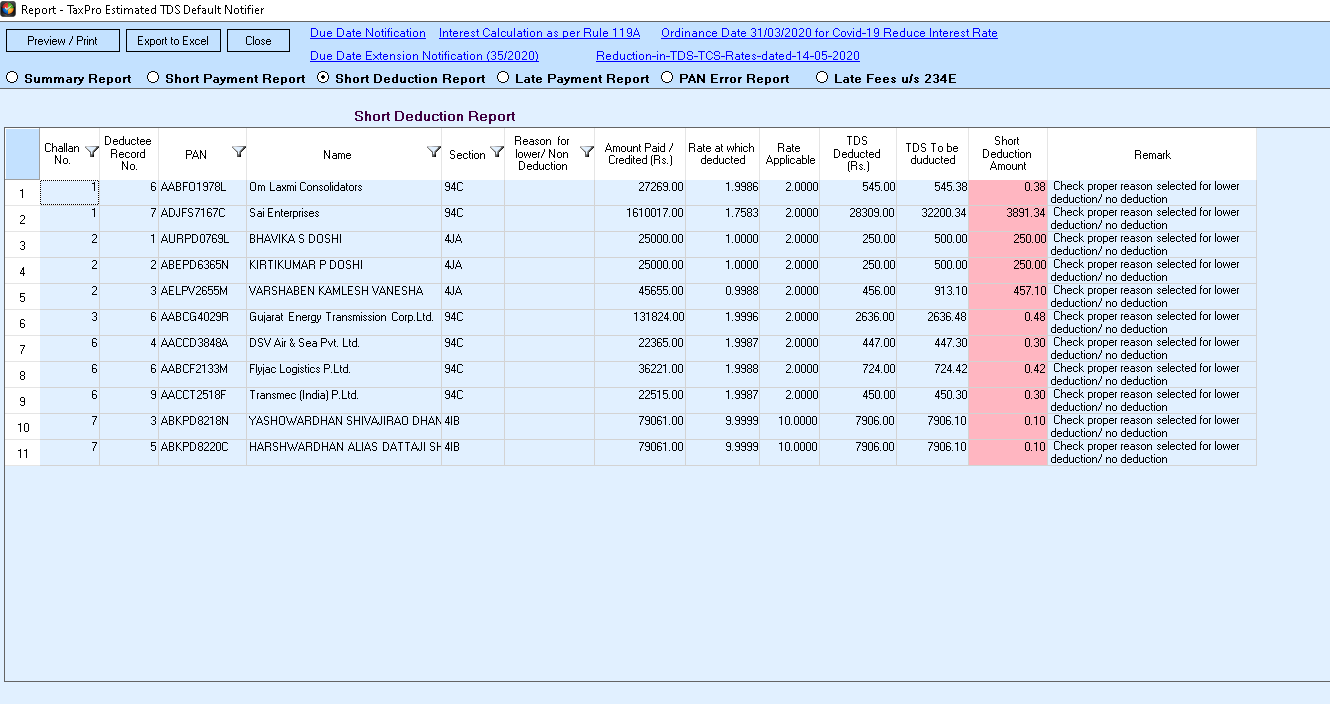

- Short Deduction Report to avoid short deduction demand from TRACES.

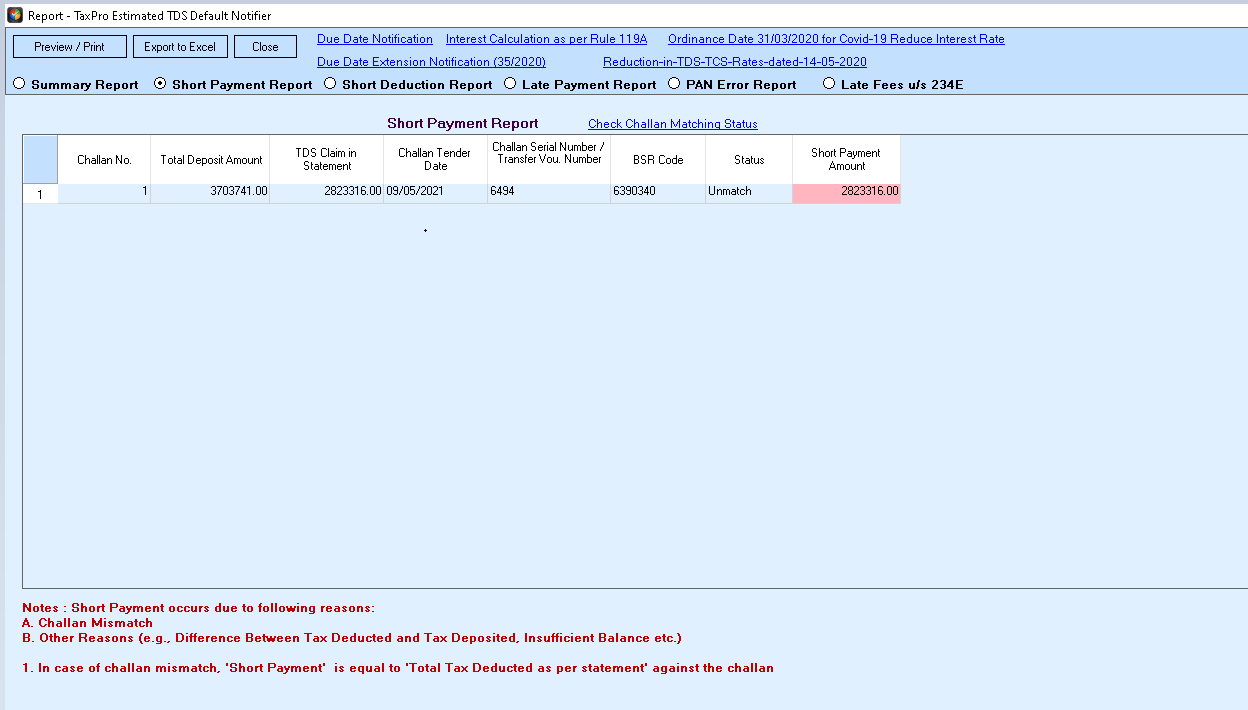

- Short Payment Report due to unmatched of challan record.

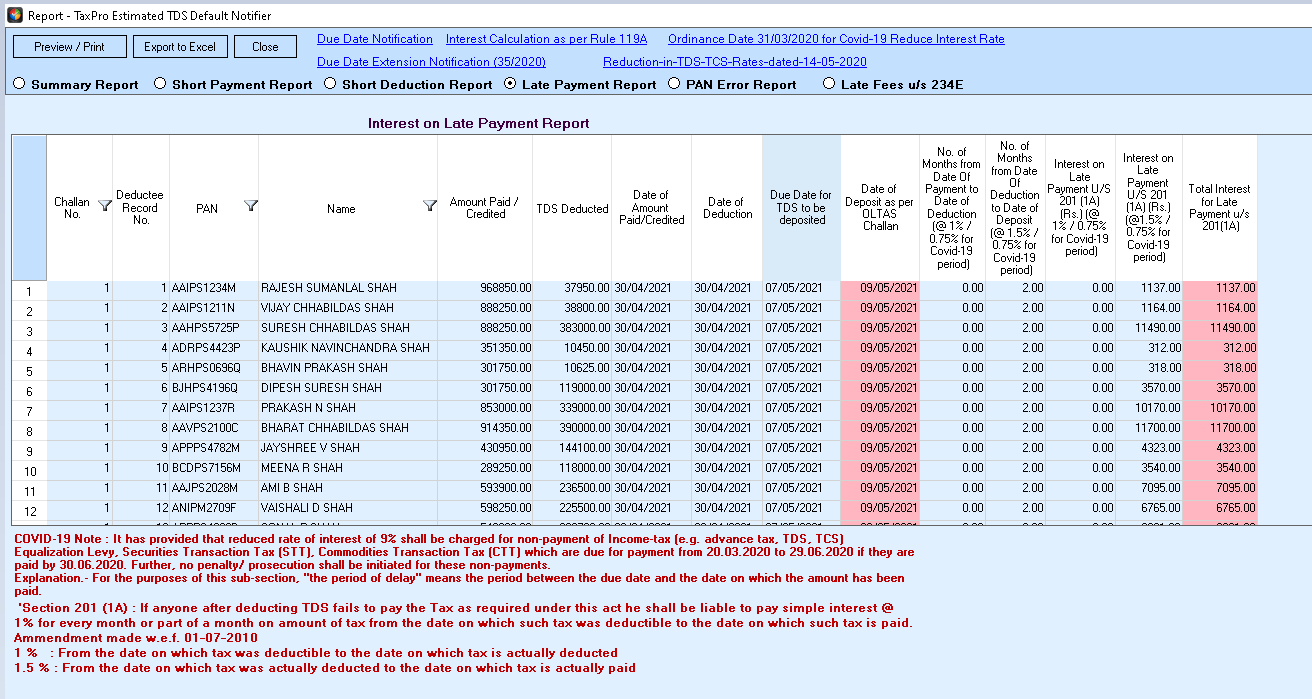

- Show Detailed Report for Late Payment Interest.

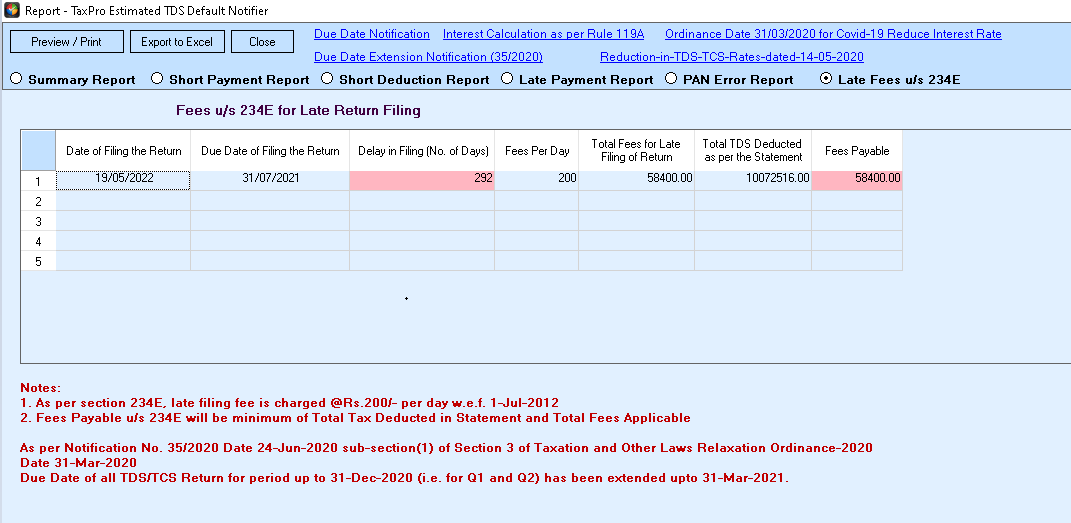

- Fees u/s 234E for Late Filing of TDS/TCS Return.

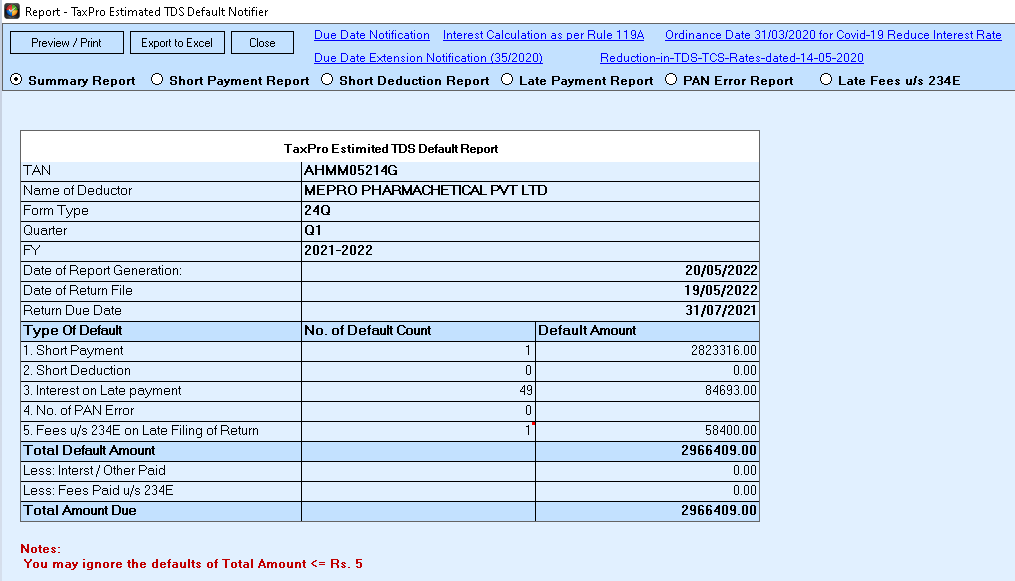

- Default Summary Report

- All Report can be Preview/Print or Export to excel.

- It supports for regular e-TDS/TCS Return File of FY. 2013-14 onwards.

TaxPro TDS Default Notifier Snapshots¶

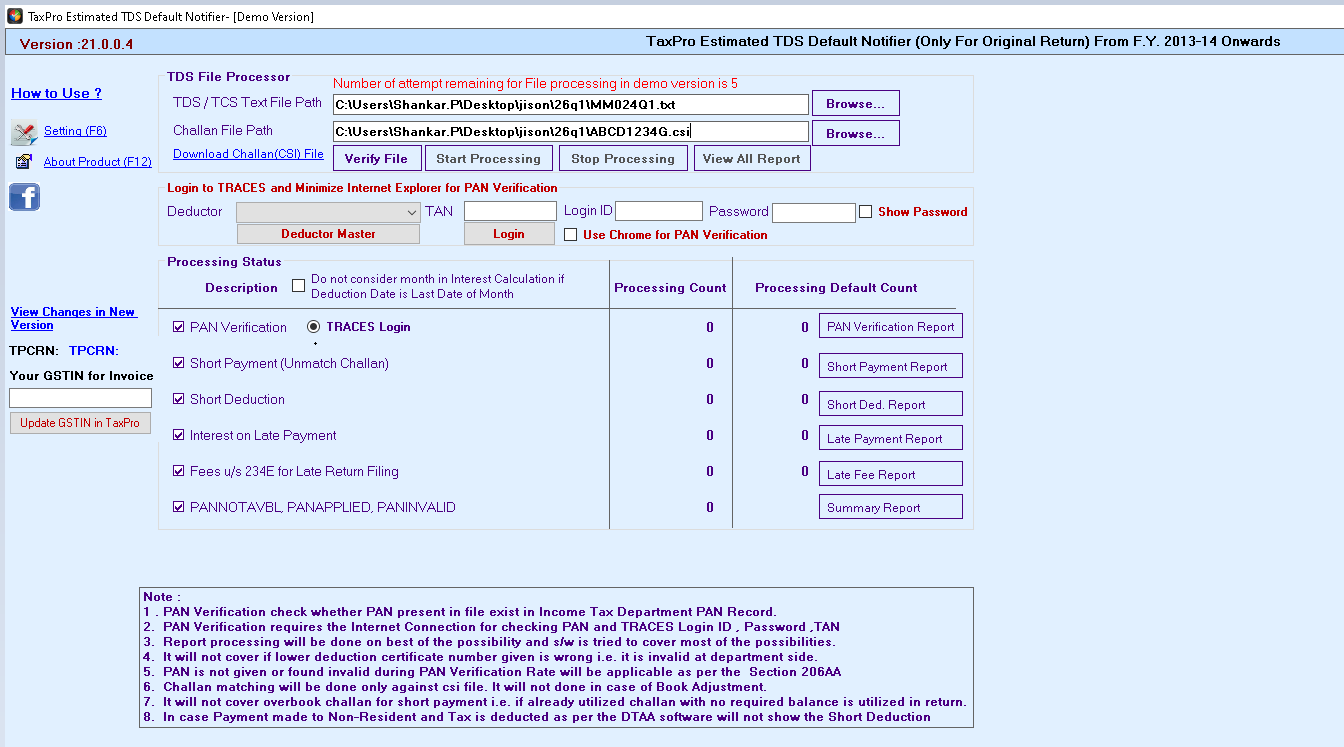

Main Page¶

PAN Verification Report¶

Interest on Late Payment¶

Short Deduction Report¶

Short Payment Report¶

Late Fee u/s 234E¶

Summary Report¶