TaxPro IT User Guide¶

Computation¶

Income from Business & Profession¶

Features Summary¶

Features Summary

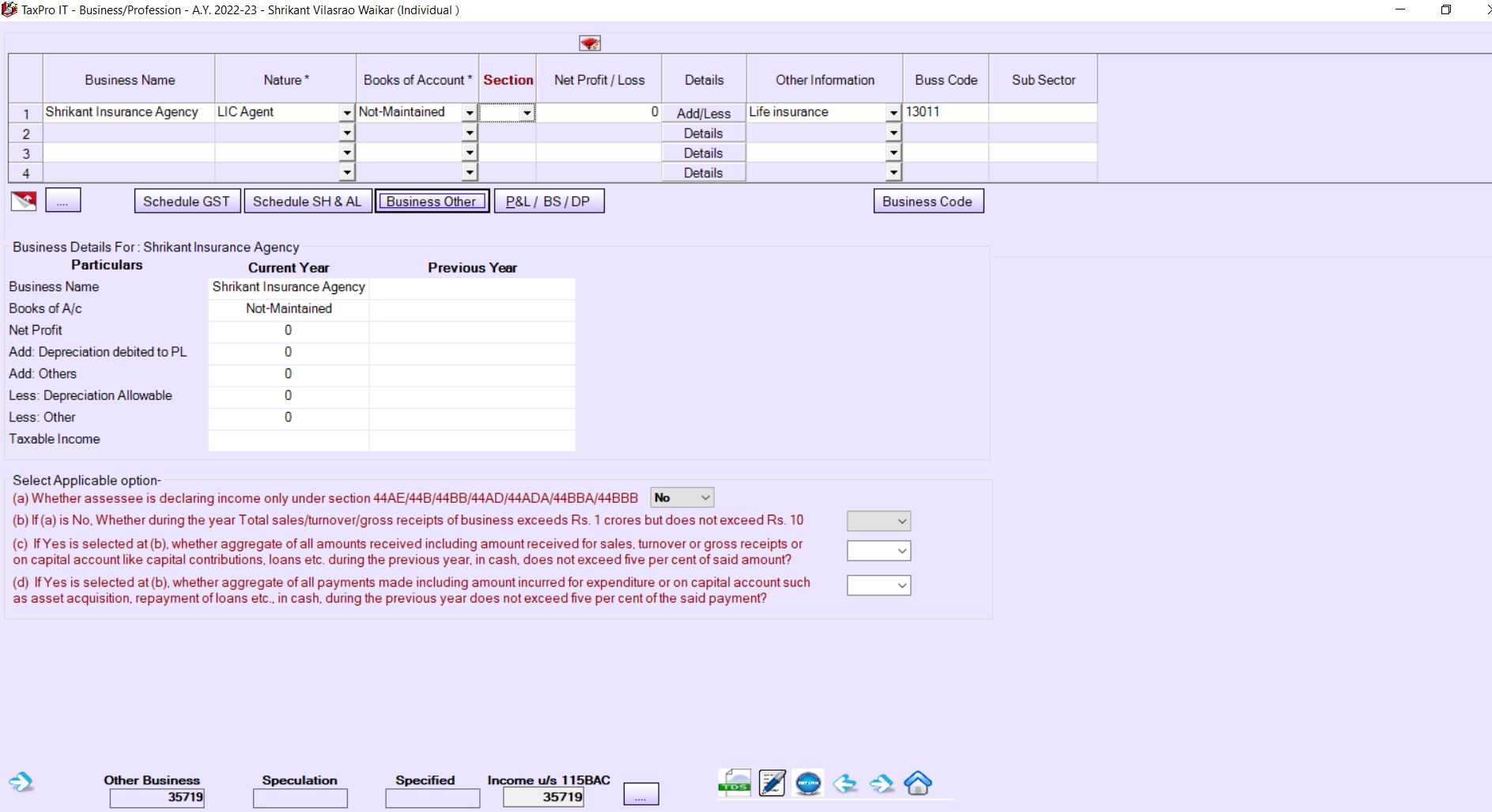

- Support to provide Multiple Business Income

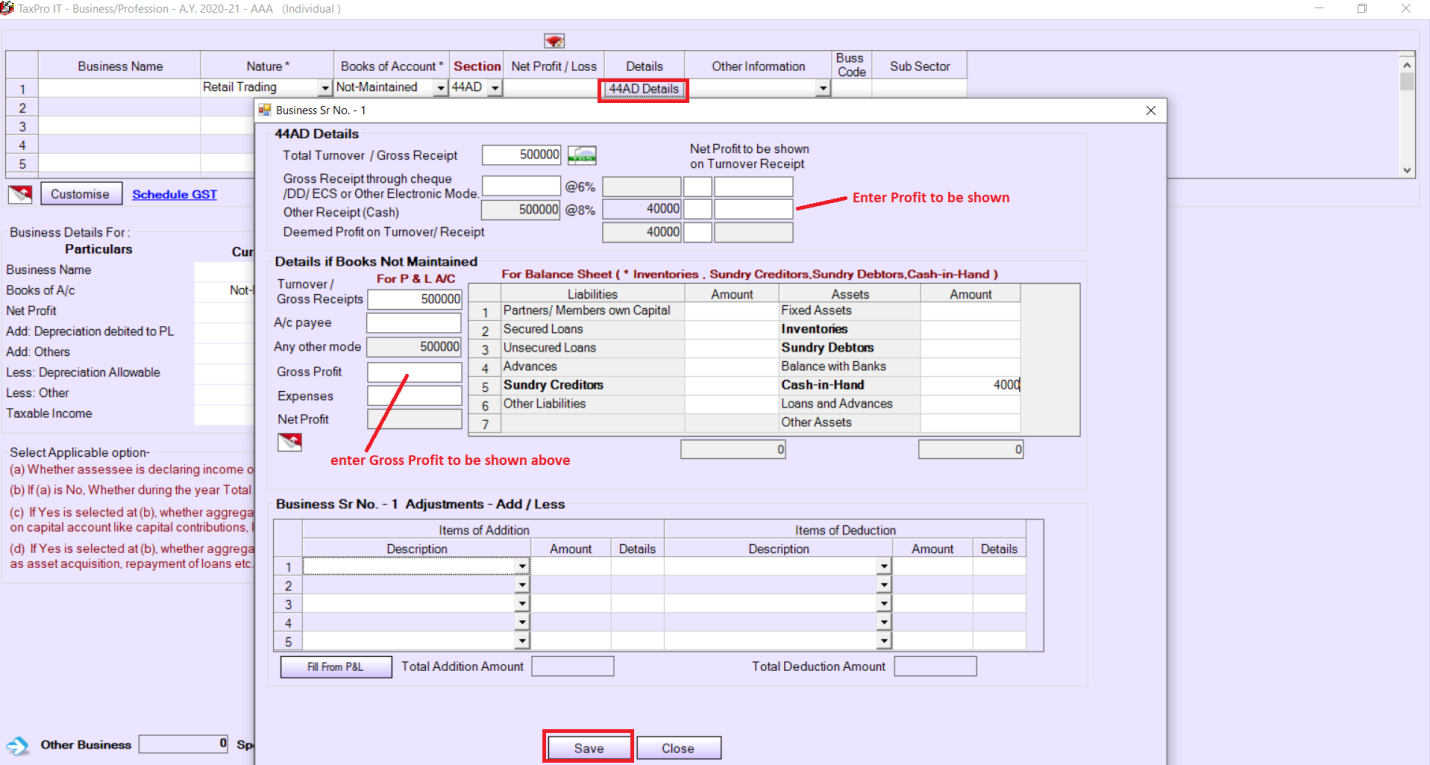

- Assign various Audit Status along with Setion for each business / profession

- Facility to provided Balance Sheet and Profit & Loss Account details

- Support for accurate AMT / MAT Calculation

- Schedule GST, SH and AL required for ITR Filing

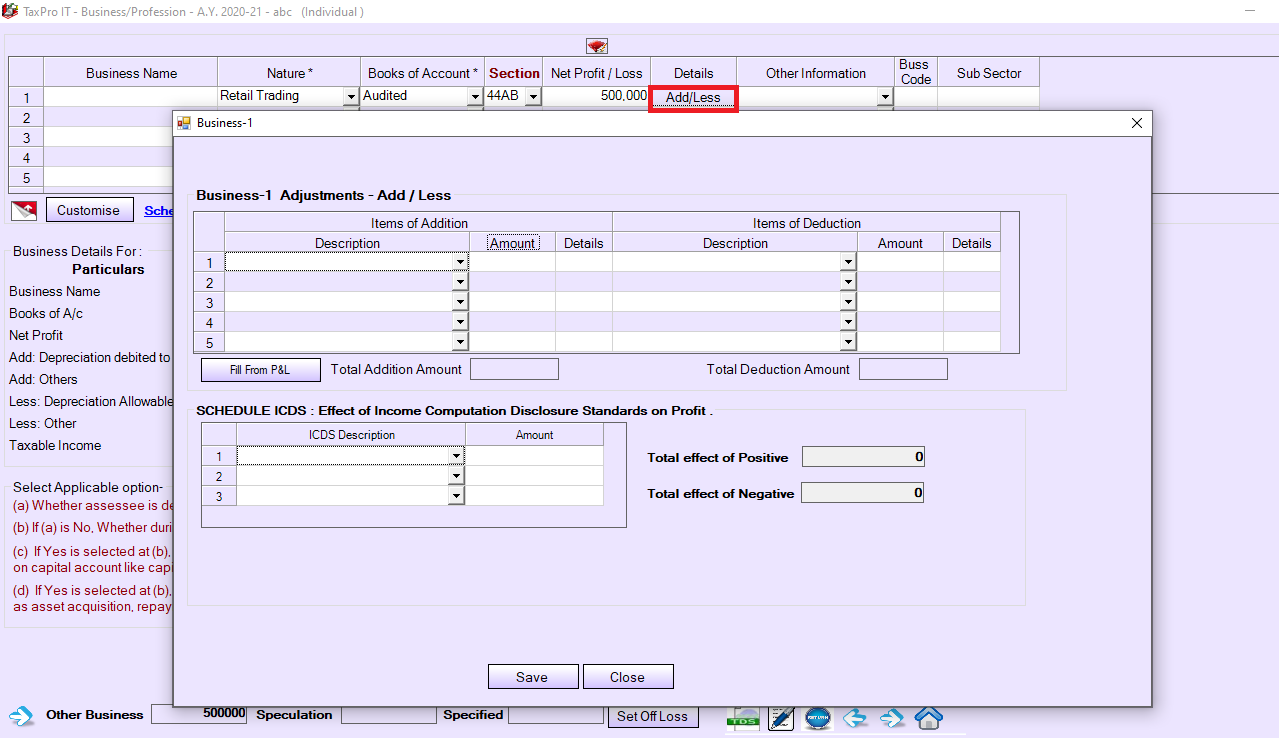

- Support to provide Add/Less Details for each business / profession

- Support to provide Depreciation Chart

- Auto Calculation of Taxable Business income Regular as well as u/s 115BAC

Normal Entry¶

Add / Less In case of Non-Audited Business / Profession¶

Add / Less In case of Audited Business / Profession¶