TaxPro IT User Guide¶

Computation¶

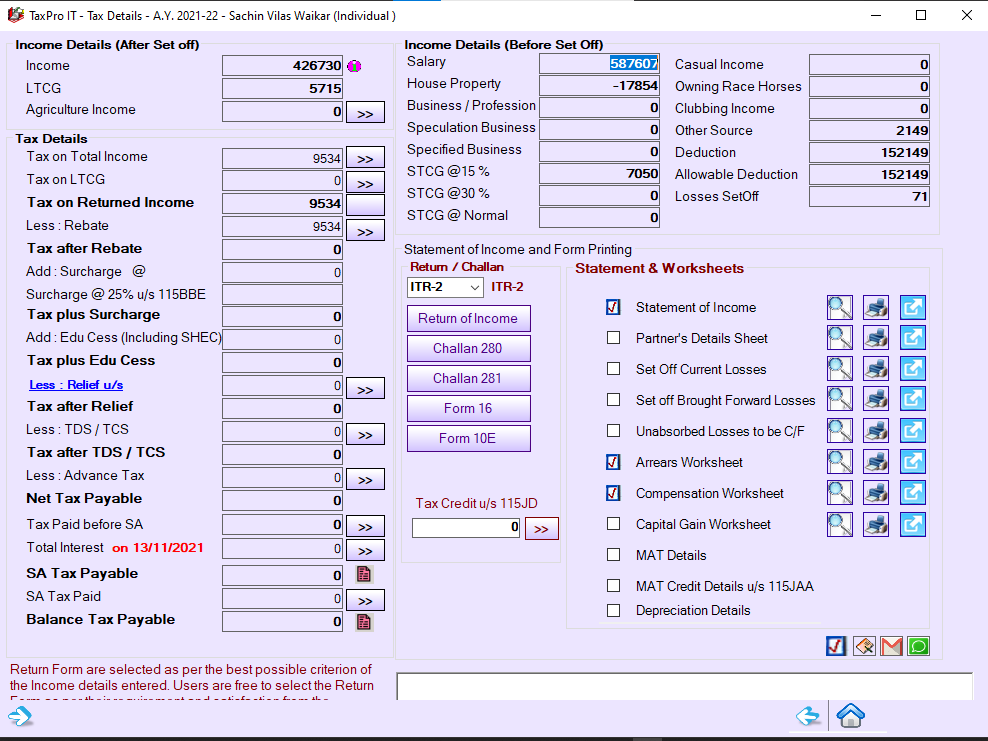

Tax Details¶

Computation of Tax¶

Computation of Tax

- Tax Details window shows detail working of the computation of tax, which changes on fly with change of any information.

- Agricultural income, if any, can be entered here.

- Use the buttons marked as ‘»‘ to open and insert the details relating to the particular item.

- Shows Details of Taxable Income and Tax

- Shows Tax under different head like Regular, LTCG, STCG…etc.

- Auto Calculation of Surcharge along with Marginal Relief.

Rebate and Relief¶

Rebate and Relief

- Auto calculation of Rebate u/s 87A

- Relief u/s 89 if any gets automatically populated here, with detailed working reported in Statement of Income.

TDS and TCS¶

TDS and TCS

- TDS/TCS Details can be Auto Fill from 26AS or AIS or from excel.

- In TDS/TCS Details Income Heads will be selected as per section in TDS Details.

Advance Tax¶

Advance Tax

- If assessee is liable to pay advance tax, the installment entered in advance tax table will automatically calculate shortfall of installment if any and interest u/s 234C.

- Details of Advance Tax Paid can be imported from AIS

- Accurate Advance Tax Liability in case of Capital Gain acoording to quarter in which gain arises.

Self Assessment Tax¶

Self Assessment Tax

- Self Assessment Tax details can be imported from AIS

- e-Payment of Self Assessment Tax Challan 280 as per liability in Tax Details

- If Self Assessment Tax paid before the determination of income is entered then Interest u/s 234B details will be consider for correct interest calculation

Interest u/s 234A , 234B & 234C¶

Interest u/s 234A , 234B & 234C

- Calculates the Interest u/s 234A, 234B, and 234C. TaxPro does the calculation of interest assuming the current system date to be the date of filing the return.

- Date of filing can be change manually for correct date as on filing date.

- If user not satisfied with Interest Calculated then can edit manually as per own working

- Detailed working of Interest u/s 234B Calculation.

Adding Notes to Statement of Income¶

Adding Notes to Statement of Income

- You can add your Notes or Remark that can be appear in bottom of Statement of Income

Statement of Income¶

Statement of Income

- Details of Statement of Tax Computation with Assessee Information

- Details of Tax

- Reporting of Relief

- Reporting of Agriculture Income and Tax

- Reporting of MAT / AMT

- Reporting of TDS/TCS

- Reporting of Interest

Auto Selection of ITR as per Income Head¶

Auto Selection of ITR as per Income Head

- Return ITR-1 to ITR-7 will be auto selected as per Income Present in different heads.