TaxPro GST User Guide¶

How to File GSTR-3B Return using TaxPro GST Software?¶

How to file GSTR-3B?

- Select TaxPayer For which you want to File GSTR-3B.

- Get GST Auth Token for GSTR-3B Filing using API.

- Select GSTR-3B from Navigation Menu.

- Select Return Period i.e. FY and Month

- Select View Mode Saved Data [Default].

- Click on Auto Fill from GSTN. It will fill System Computed GSTR-3B from portal using API. Field hilighted with blue color will be Auto Fill.

- Check and Edit Data wherever require.

- Click on Save Data button.

- Click on Upload Data.

- Click on Download Data and Check your data is proper or not.

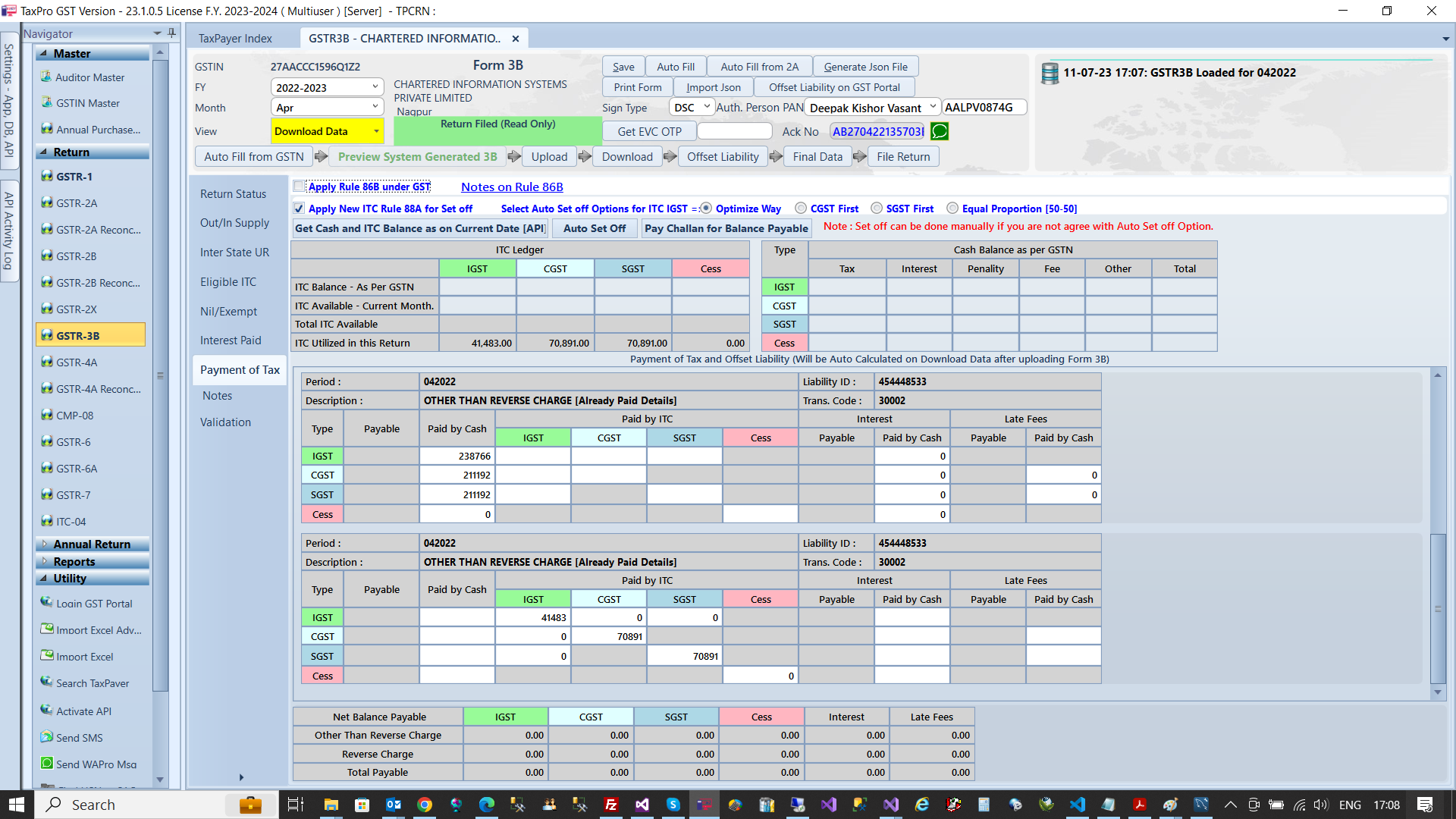

- Click on Payment of Tax tab which will show all tax liability.

- Click Get Cash and ITC Balance as on Date. Which will fetch data from ITC and Cash Ledger using API and Setoff against Payment.

- Click on Offset Liability.

- Click on Final Data and Check data properly before proceeding to File Return.

- Select Sign Type DSC/EVC and Auth. Person PAN.

- In case of EVC click on Get EVC OTP -> Enter OTP -> Click on File Return

- In case of DSC, insert DSC Token and Click on File Return.

- After File Return Successful Acknowledgement No. will be received.