TaxPro GST Features¶

TaxPro GST is widely used best GST Return Filing Software.

TaxPro GST Features Are as Listed Below¶

TaxPro GST has made GST adorable for you.¶

Features Summary

- State of art Assessee/Client Index.

- GST Return Filing using API without GST Portal Login.

- Easy to Use Software.

- Annual data for GSTR 1, 2A, 3B, 4A, 9 on a single click.

- Transfer data from any software through Excel or Json.

- Automatically fills most of the GSTR through auto data populate from one Form to other or using API.

- Keep track of the filing status of all clients/businesses through the unmatched Assessee Index.

- Download or Export.

- 100% accuracy in GST Filing.

With TaxPro GST, File your GSTRs in few moments & clicks¶

File GST Return in few moments & clicks

- Auto-prepare data for GSTR-1 & GSTR-3B Filing.

- Easy import of data, directly from accounting software.

- Ability to work online as well as offline.

- Export data and reports to share with colleagues and clients.

- GSTR 9C offline hash signing utility for Auditors.

- Reconcile GST data with Books of Accounts.

- Auto Fill GSTR-3B , GSTR-9, GSTR-9C, GSTR-4 Annual from GST API.

- Auto generate GSTR 9 in just a click of button.

- Reconcile GSTR-2A and Purchase data in 1-click.

- Reconcile GSTR-2B and Annual Purchase Register in 1-click.

- No manual data entry required.

Who can use TaxPro GST Software?

Professionals offering Tax Consultancy, Chartered Accountants, Auditor Firms, Businesses and Enterprises, eCommerce seller firms and software development companies can use and get benifited from TaxPro GST Software

What is GST Suvidha Provider or GSP?

-

The GST environment in India is owned and managed by The Goods and Services Network [GSTN], a public-private partnership, which is the IT module and the backbone of the of GST framework in India. To strengthen and smoothen the interaction between GSTN and the tax payers, the GST Council has identified and approved few organizations in India as GSPs bounded with strict regulations and periodic audits.

-

GSPs have the job of creating interactive and easy to use software to enable the ultimate taxpayer to interact with the GST ecosystem in an easy to use way. Ease of use is one of the most fundamental concerns to consider when one of the ultimate goals is to increase the number of taxpayers in the Country. A GSP basically provides a third party application which acts as a bridge and synchronizes with the tax payer’s existing ERP, Accounting Softwares etc. and the GSTN, thereby easing the process for organizations, to deal with GST.

-

GSPs are equipped with secure GST APIs, which actually act as a connector while the third party GST software provides unique and convenient ways from GST registration to GST Return Filing.

-

TaxPro is one of the few GSPs initially appointed by GSTN. TaxPro is fast growing and the one of the most preferred GSP with its rich knowledge and understanding of Indian Taxtion software industry, TaxPro offers complete GST Software.

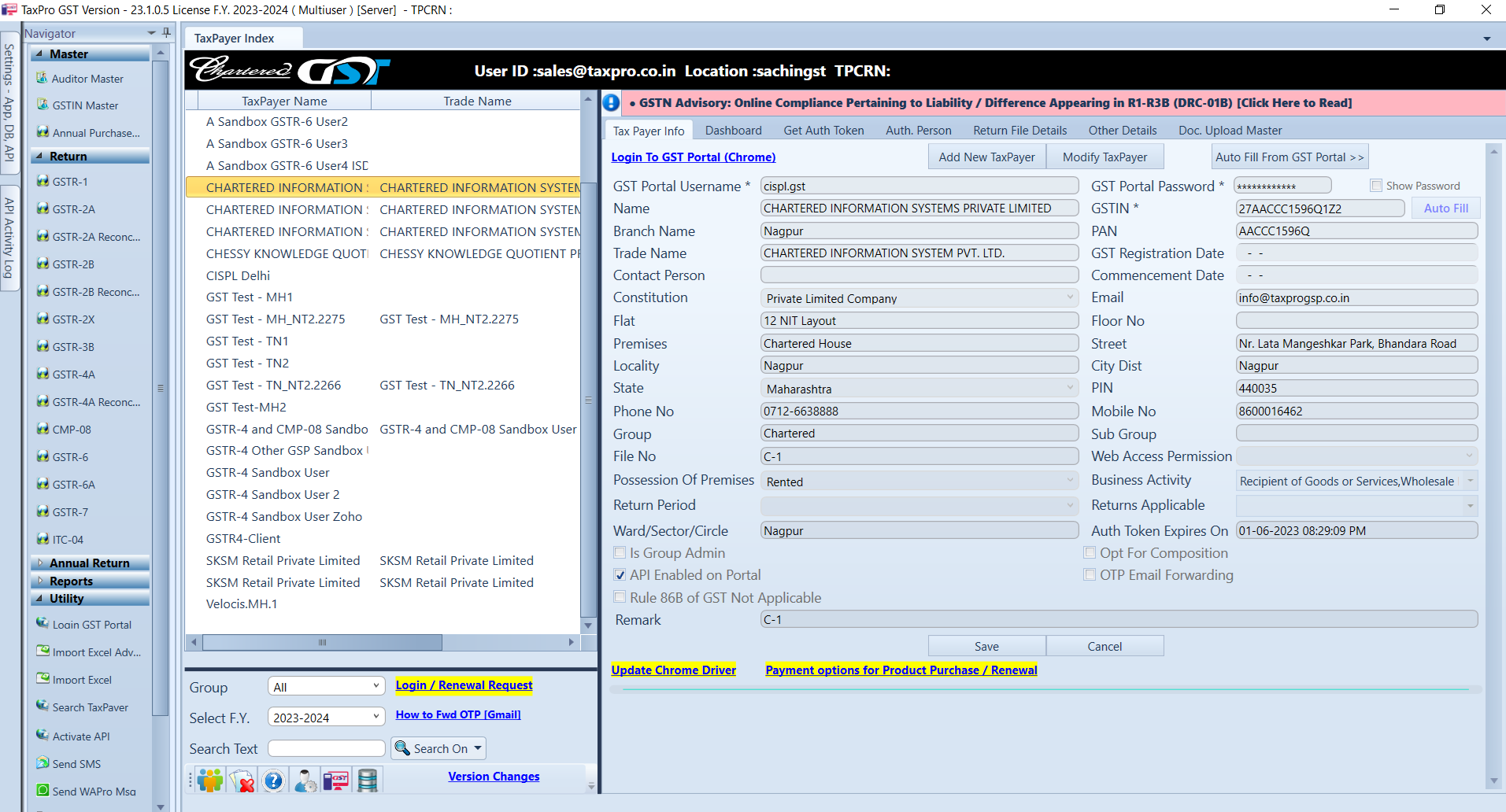

Assessee Index¶

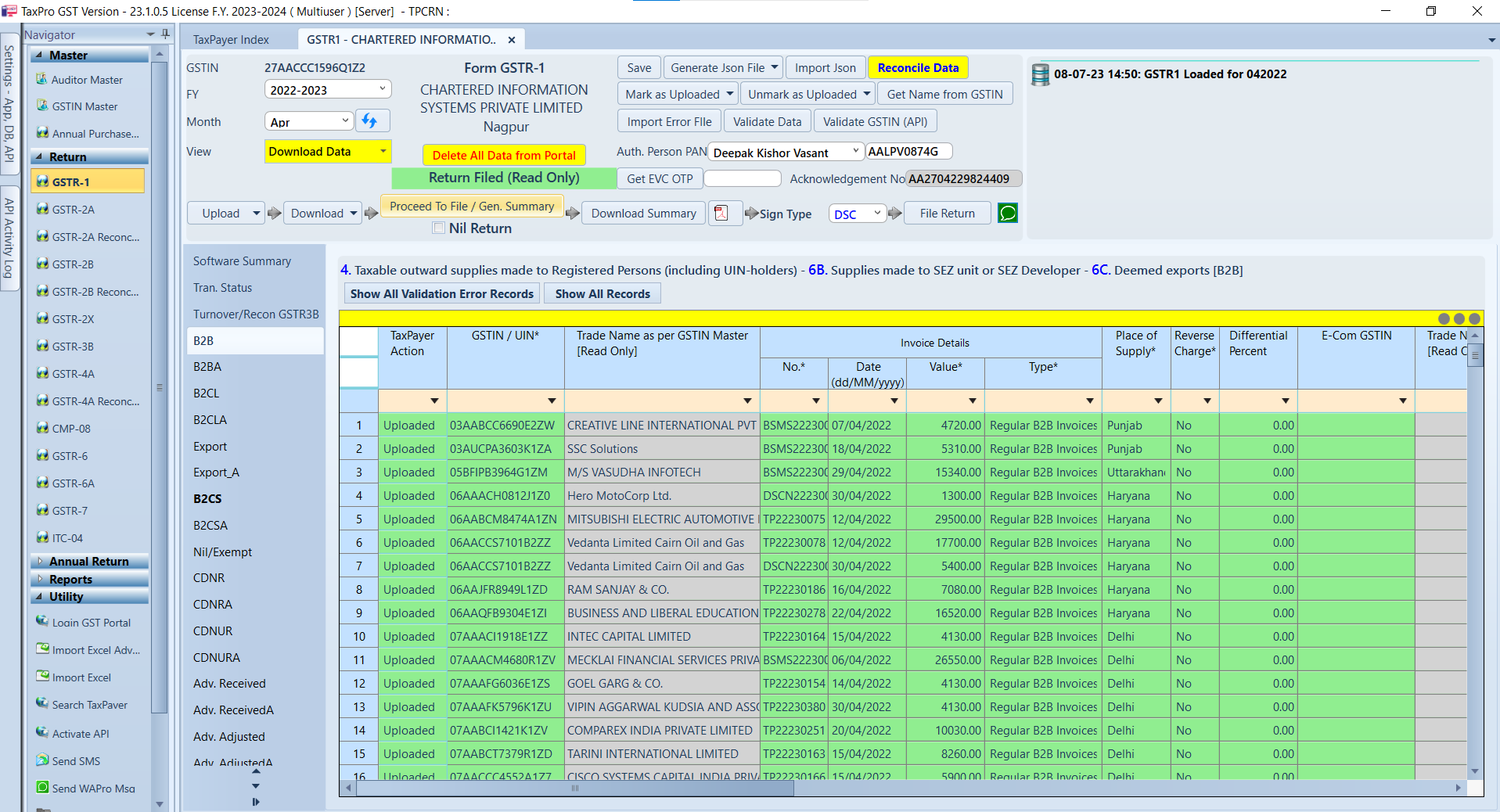

GSTR-1¶

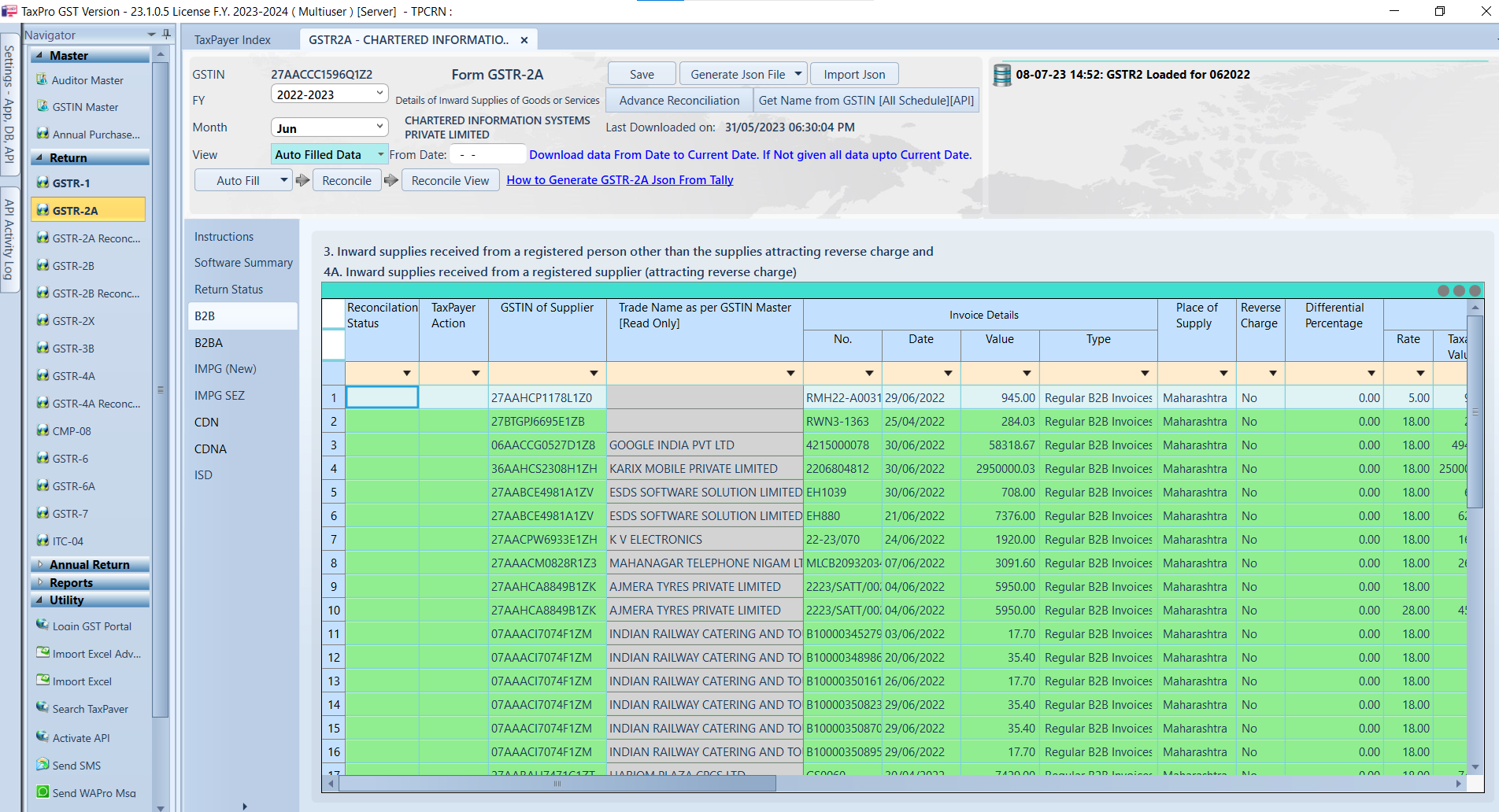

GSTR-2A¶

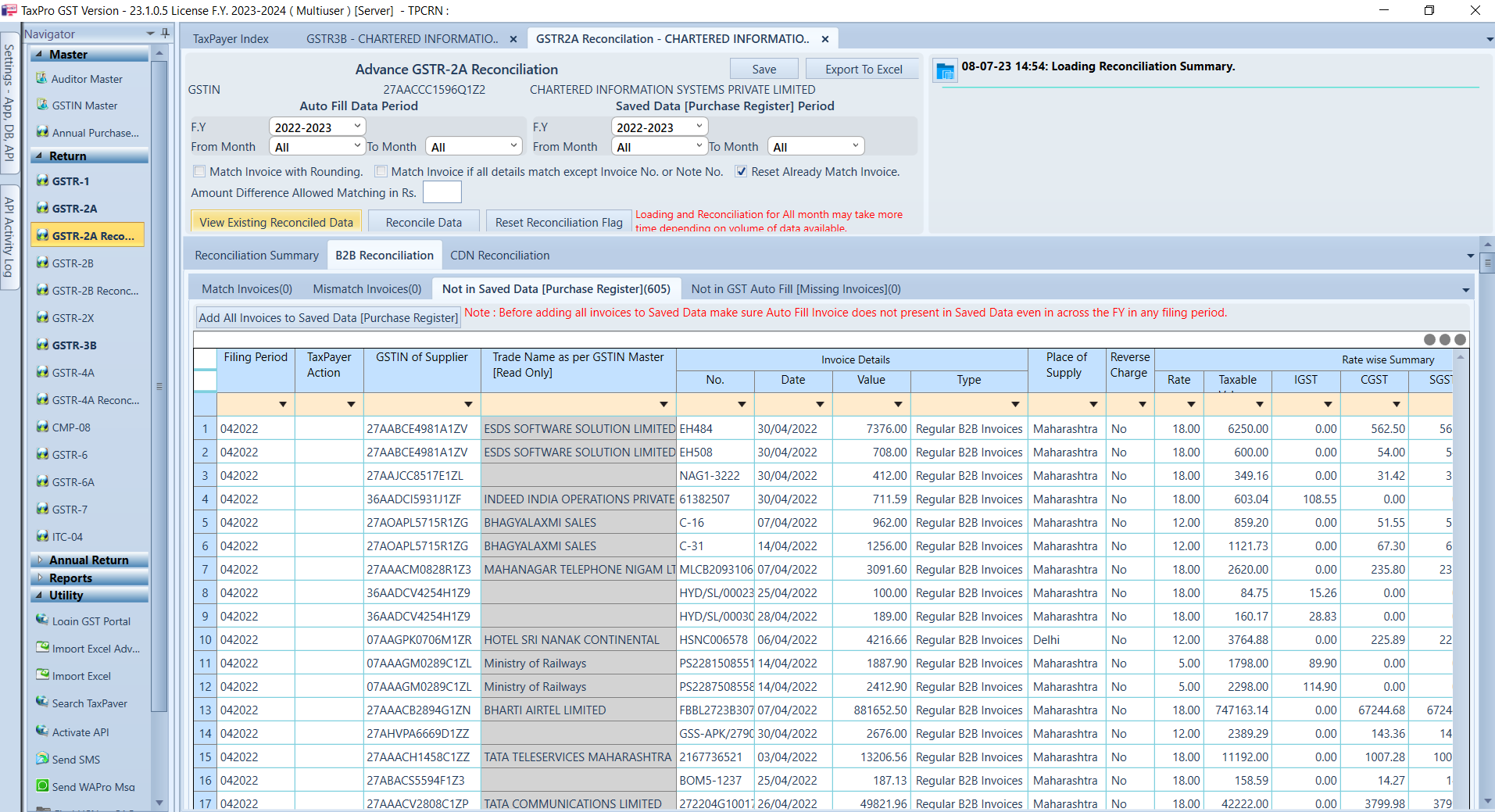

GSTR-2A Reconciliation¶

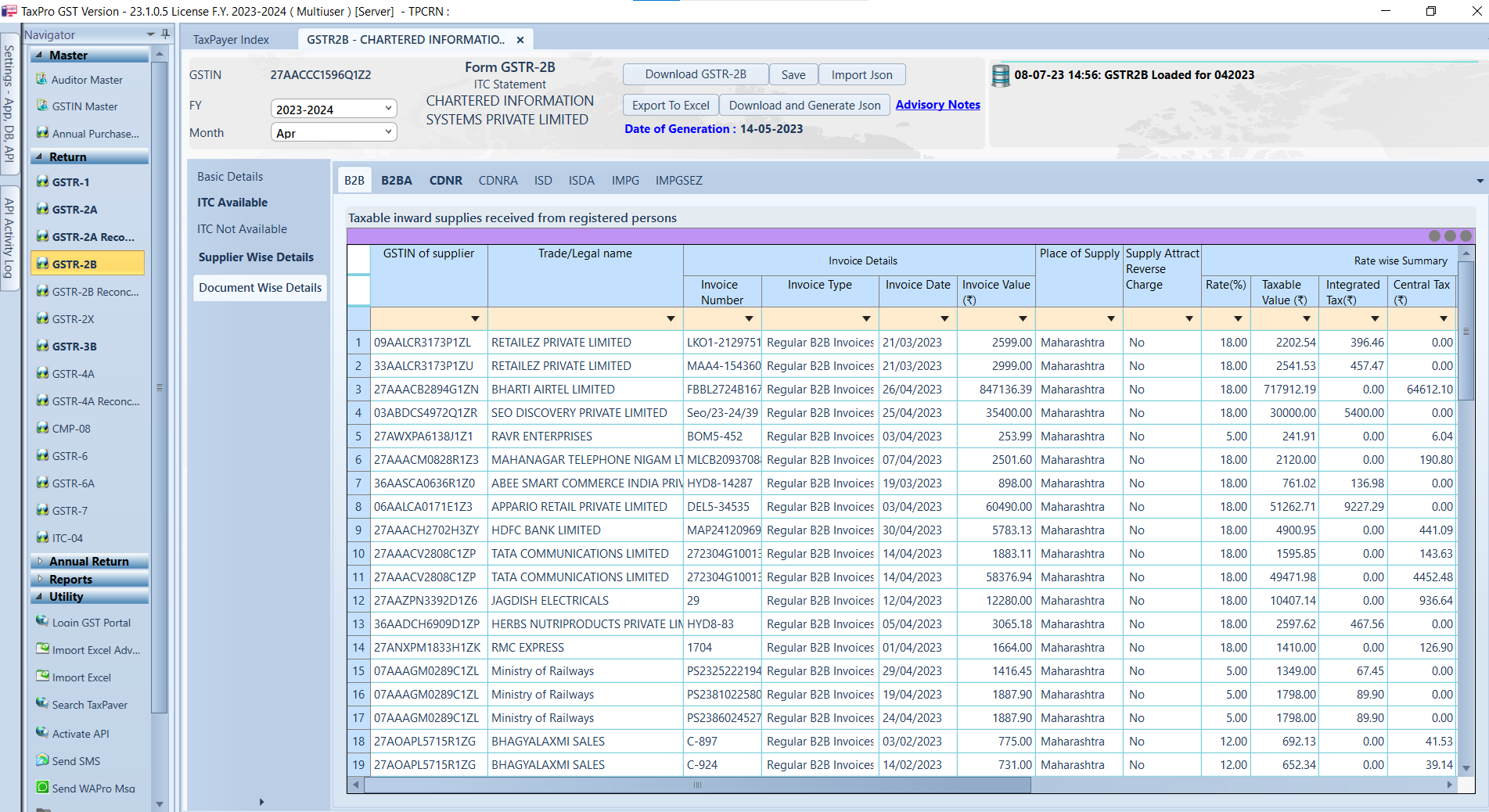

GSTR-2B¶

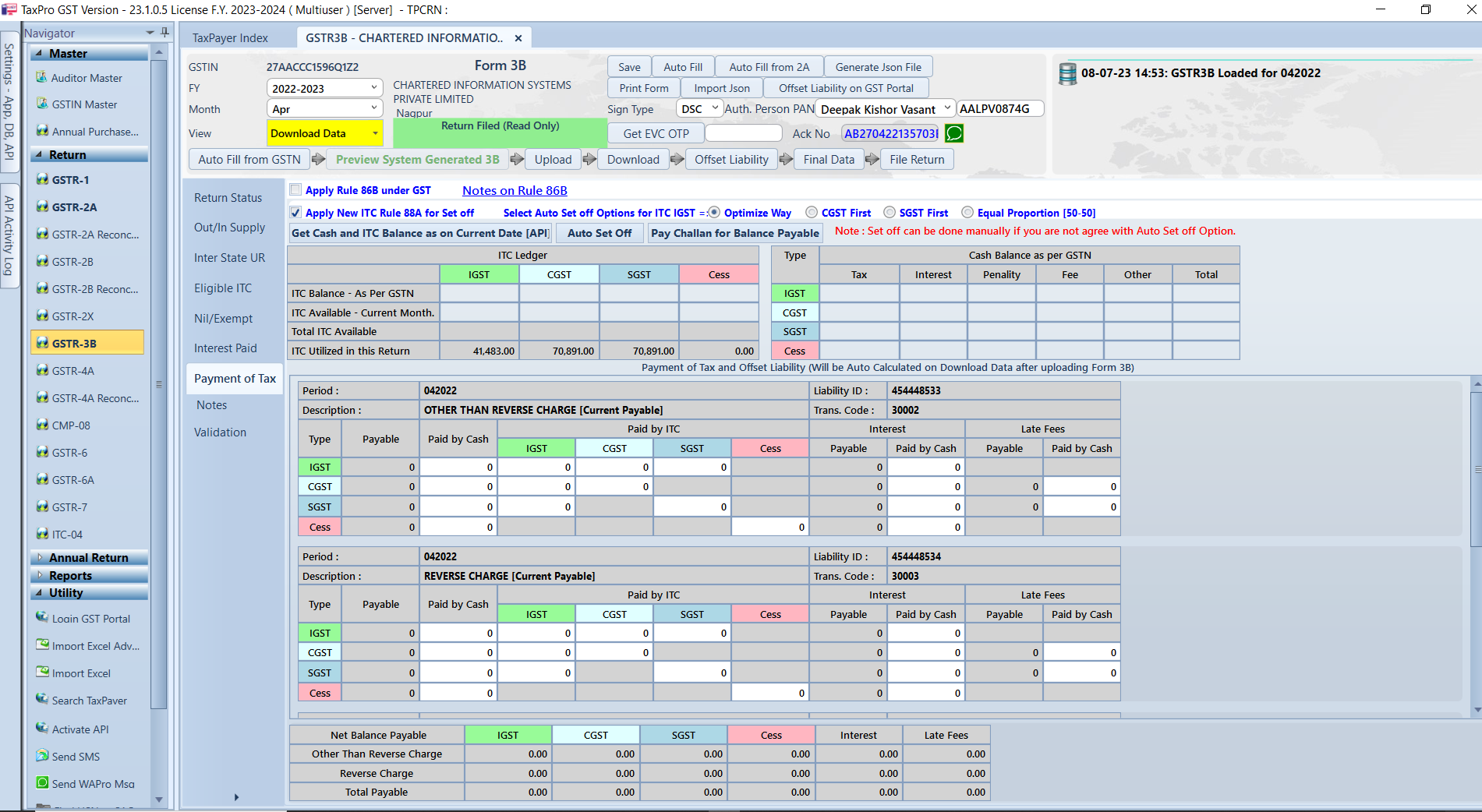

GSTR-3B¶

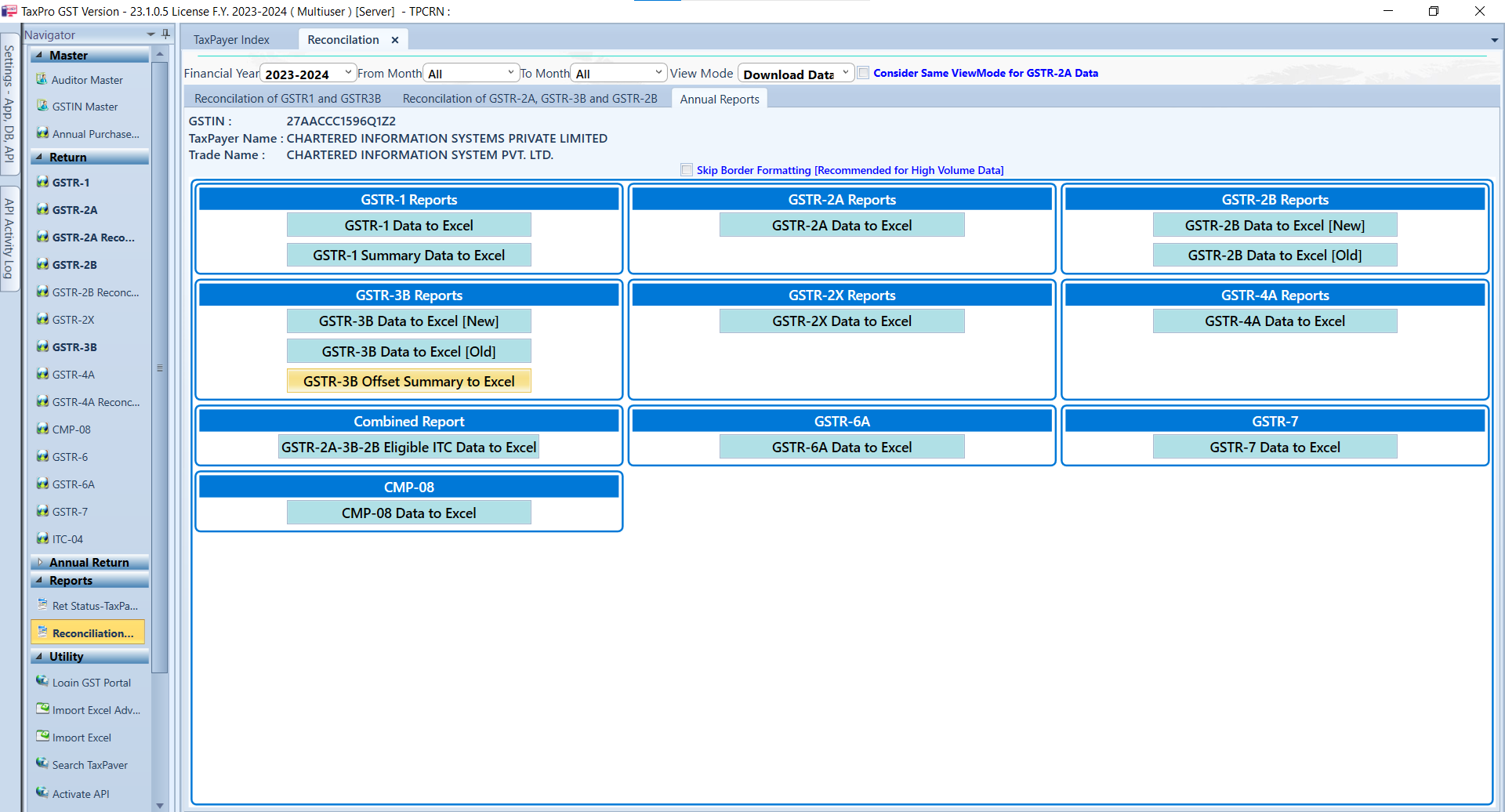

Annual Report for GSTR-1 , GSTR-2A , GSTR-2B , GSTR-4A , GSTR-3B…etc¶

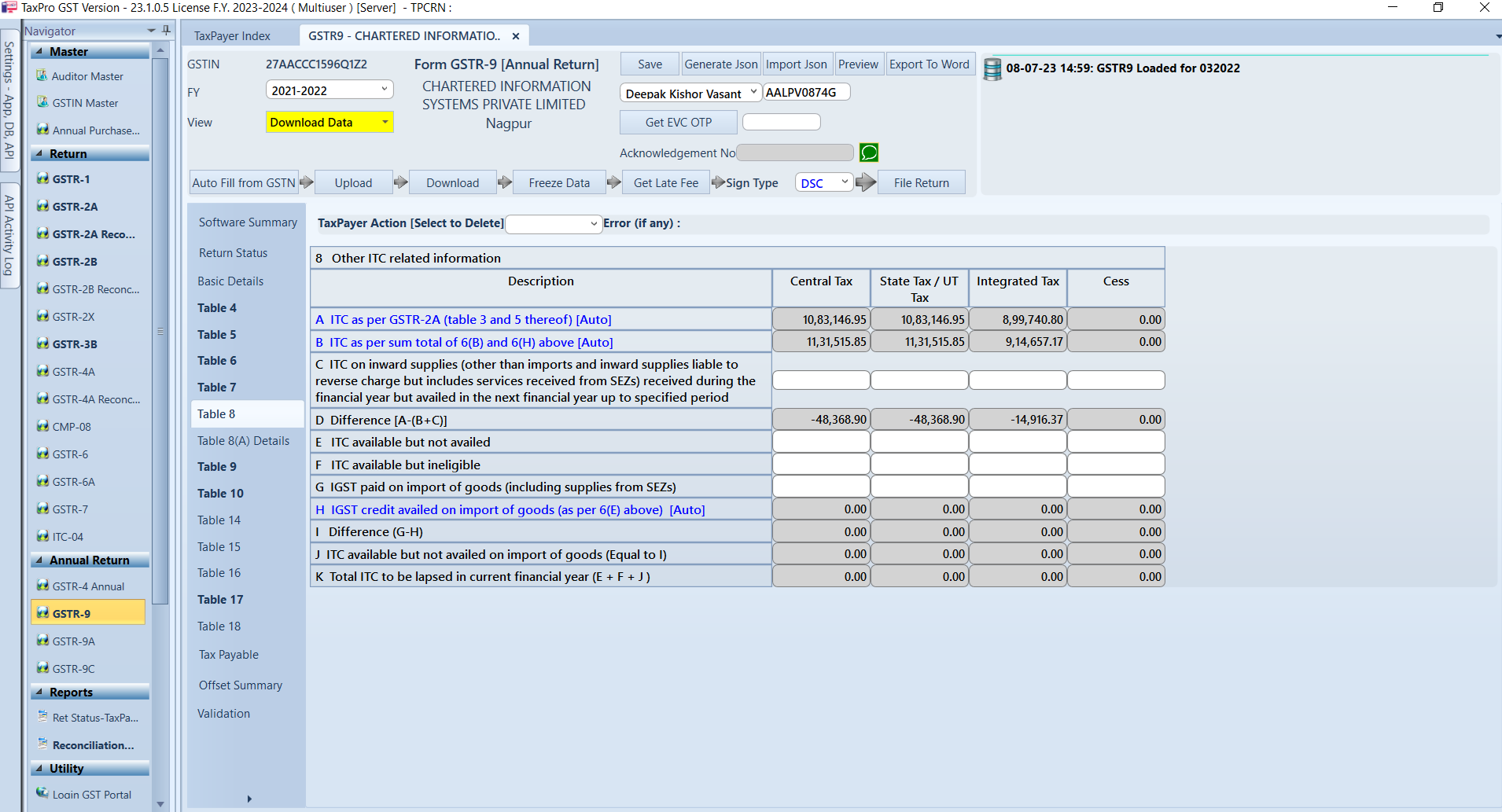

GSTR-9¶