TaxPro e-TDS Features¶

TaxPro e-TDS is widely used best TDS / TCS Return Filing Software.

TaxPro e-TDS Features Are as Listed Below¶

e-TDS Features

- Supports bulk 1.5 millions+ (15 Lakhs+) of TDS/TCS Transactions depending on Version Standard / Professional / Corporate.

- Inbuilt TDS Computation along with applicable TDS Rate and Interest for Late Payment and Late Deduction with Validation. [Corporate Version]

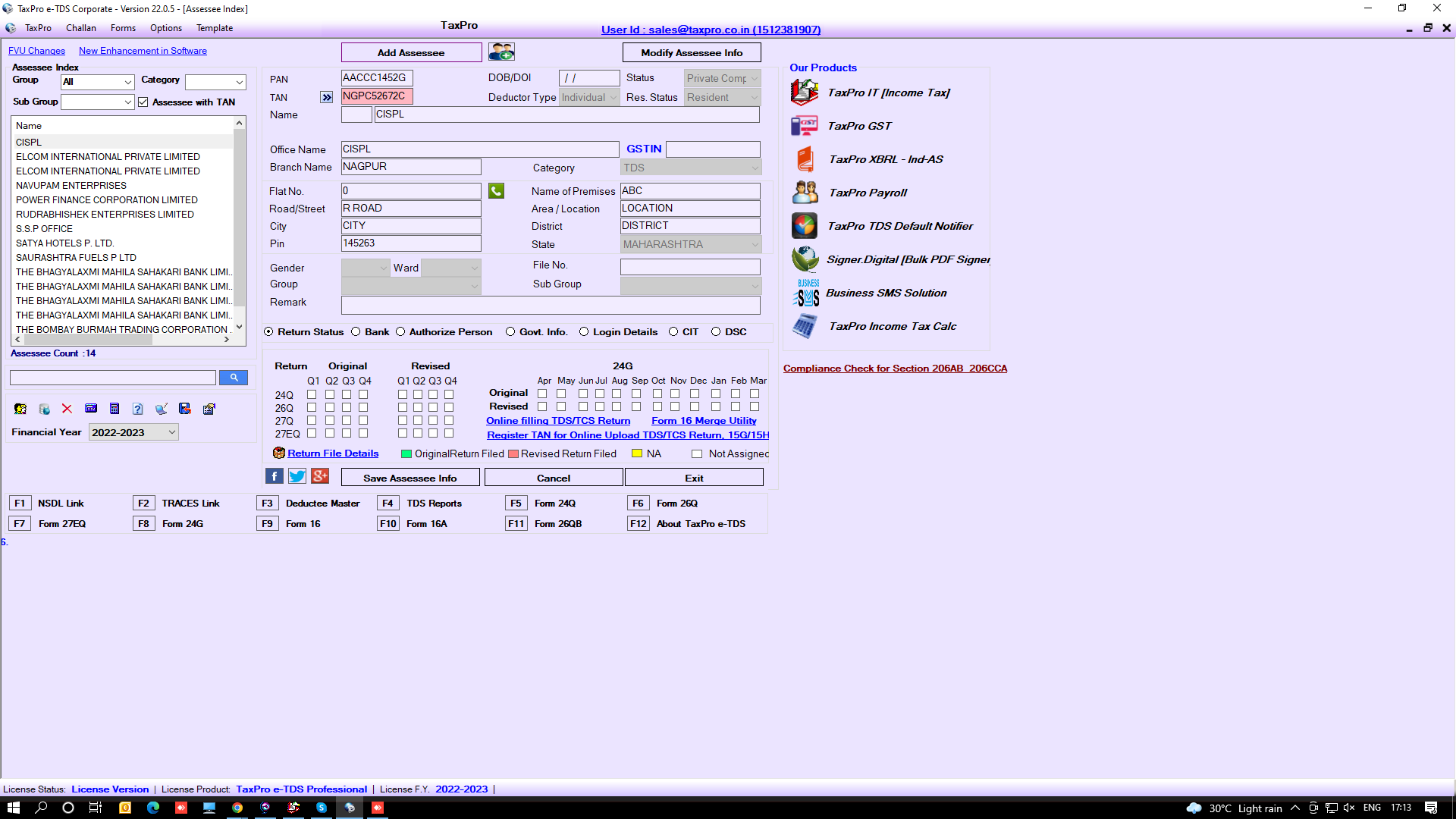

- Assessee Dashboard with innovative presentation & unlimited Assessee Support.

- Build Assessee Master Data from TDS/TCS Return Text files.

- Quarterly TDS/TCS Return Form 24Q, 26Q, 27EQ & 27Q with inbuilt validation of data.

- Direct Upload and Online Correction of TDS/TCS Returns.

- Import TDS/TCS Return Data from Excel Templates with inbuilt validation.

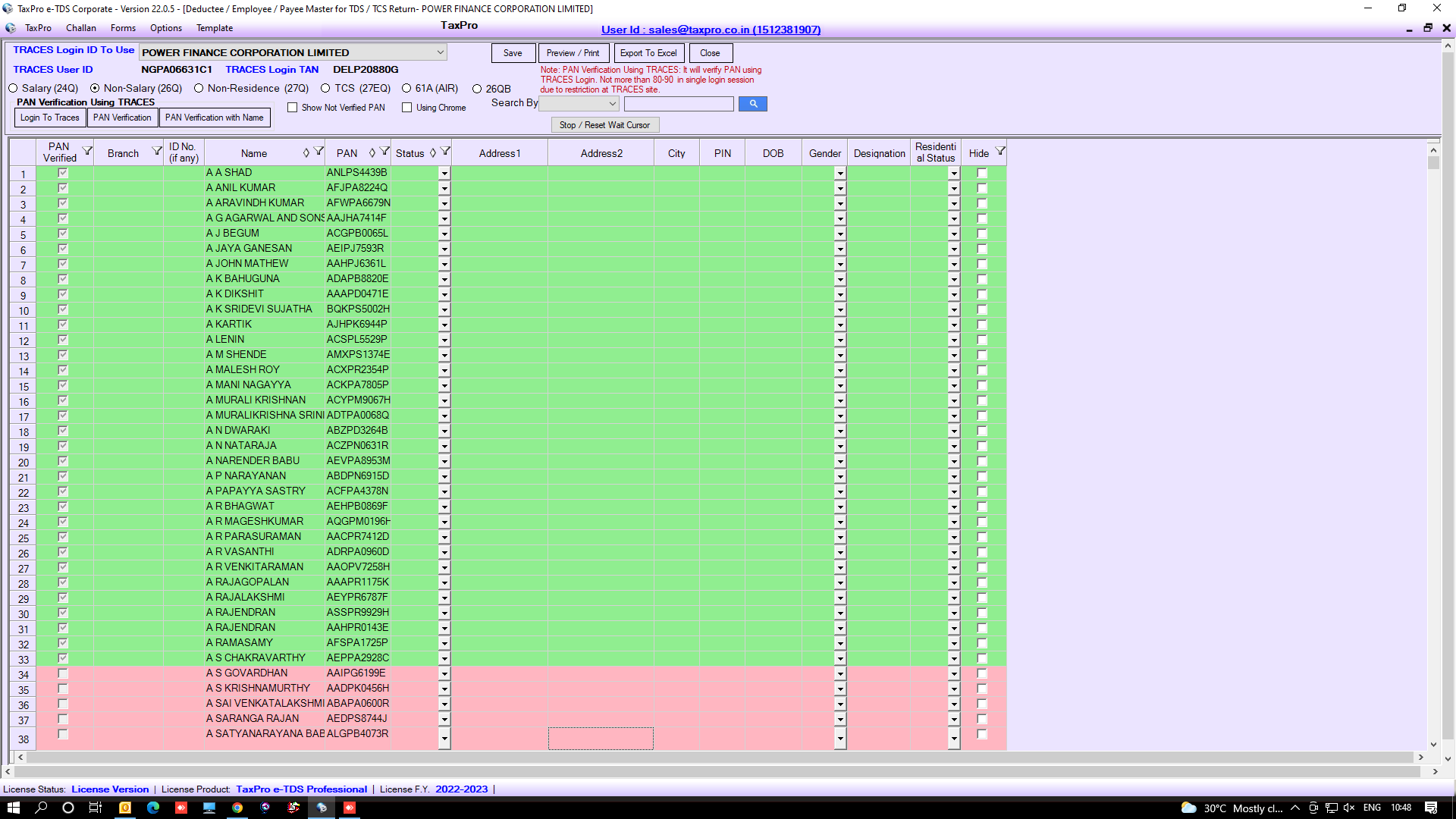

- Bulk PAN Verification for Deductee Master.

- Challans 280/281/282/26QB/26QC…etc. with e-Payment Option

- Bulk Form 16/16A PDF Generation from Software Data & From TRACES File with Digital Signature Option.

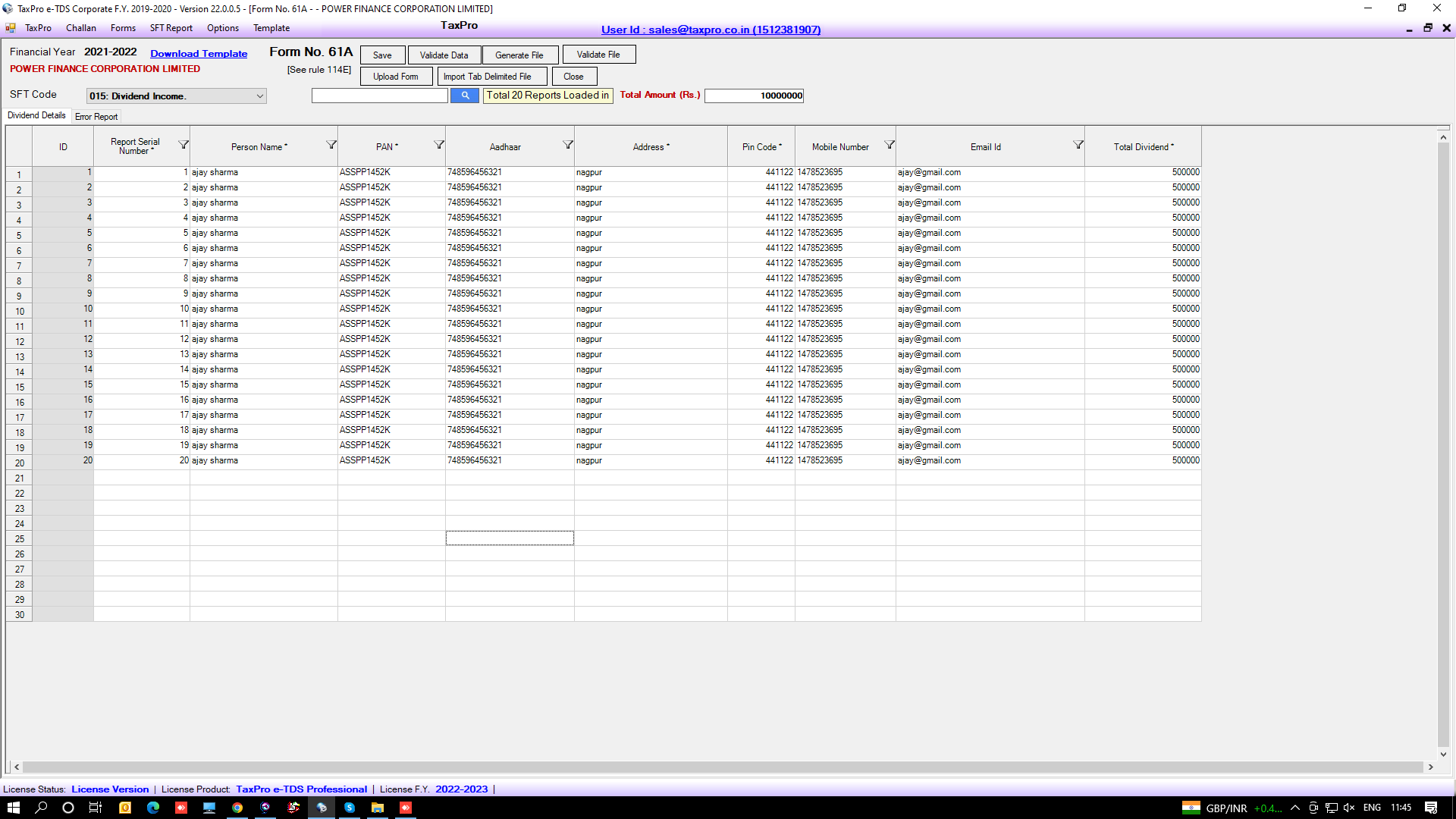

- All SFT Return, 15G / 15H returns, Other TDS Related Forms and many more.

- Compliance check for section 206AB/206CCA.

- Quick Links for TRACES Deductor Dashboard.

- Request TDS / TCS Consolidate File, Request Form 16 / Form 16A / Form 27D / Justification Report, and many more.

- Automated SMS Notification to Client option available.

Assessee Index¶

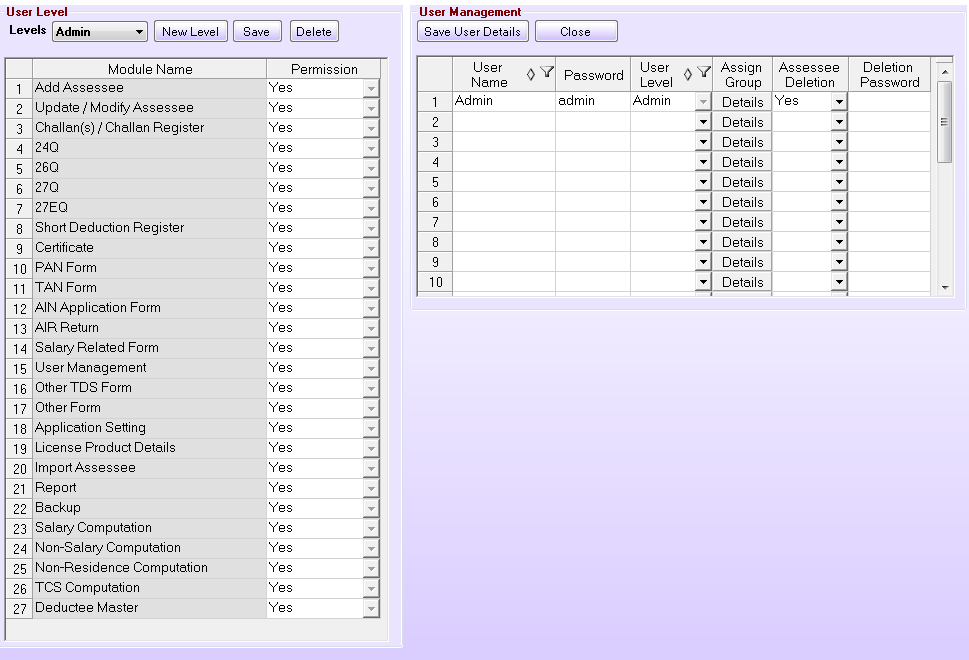

User Management¶

Deductee Master and PAN Verification¶

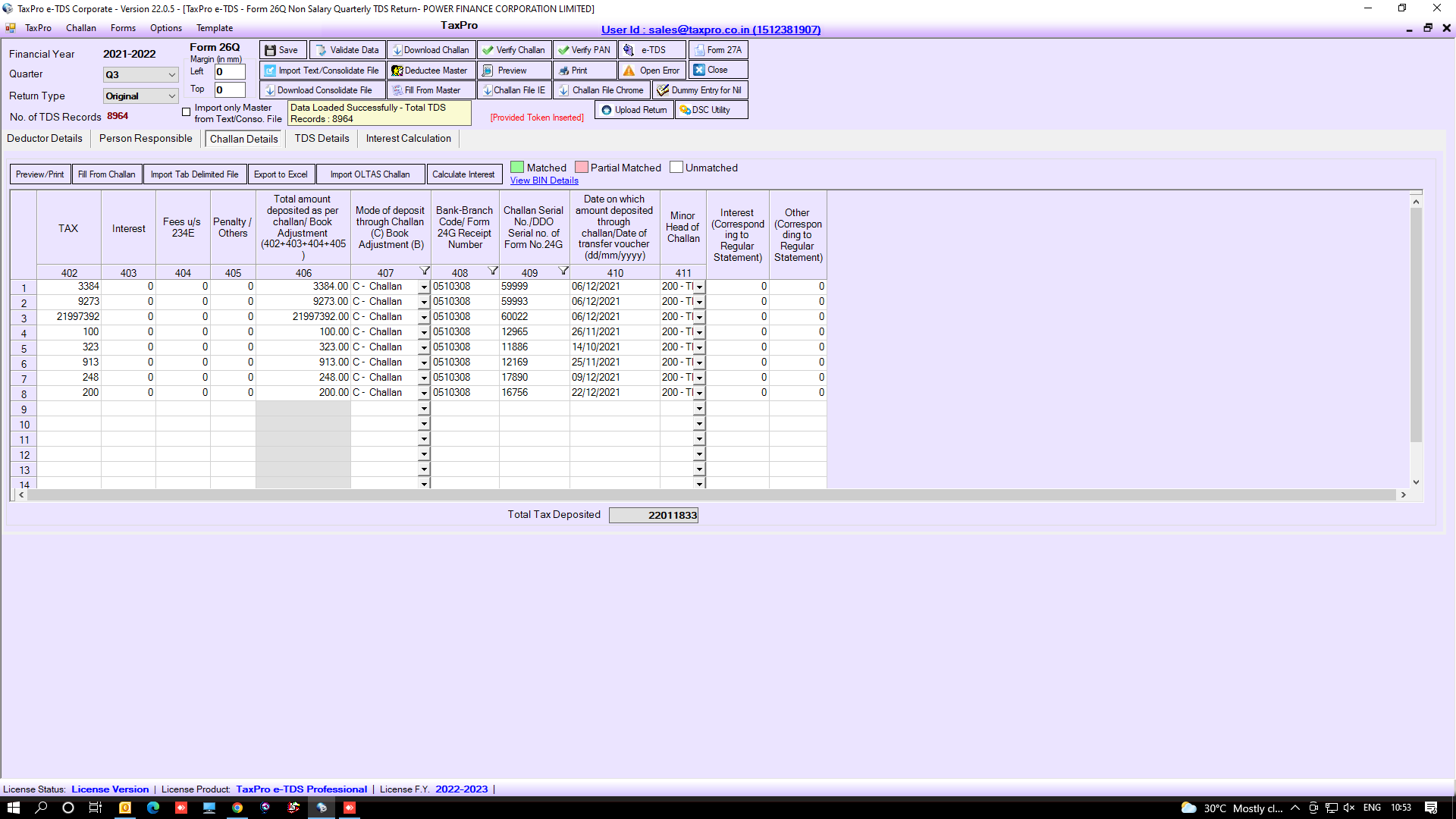

Challan Details¶

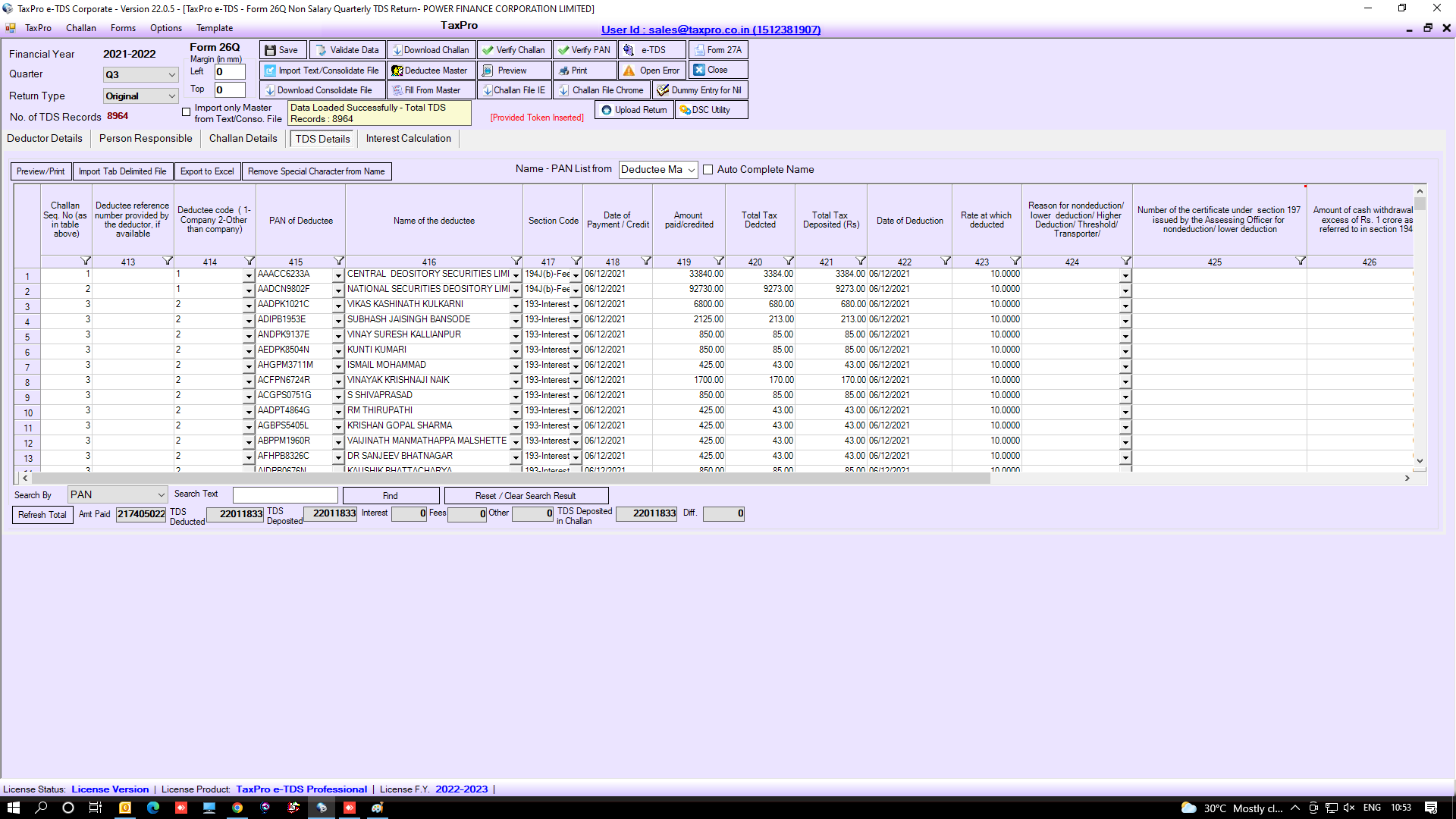

TDS Details - Form 26Q¶

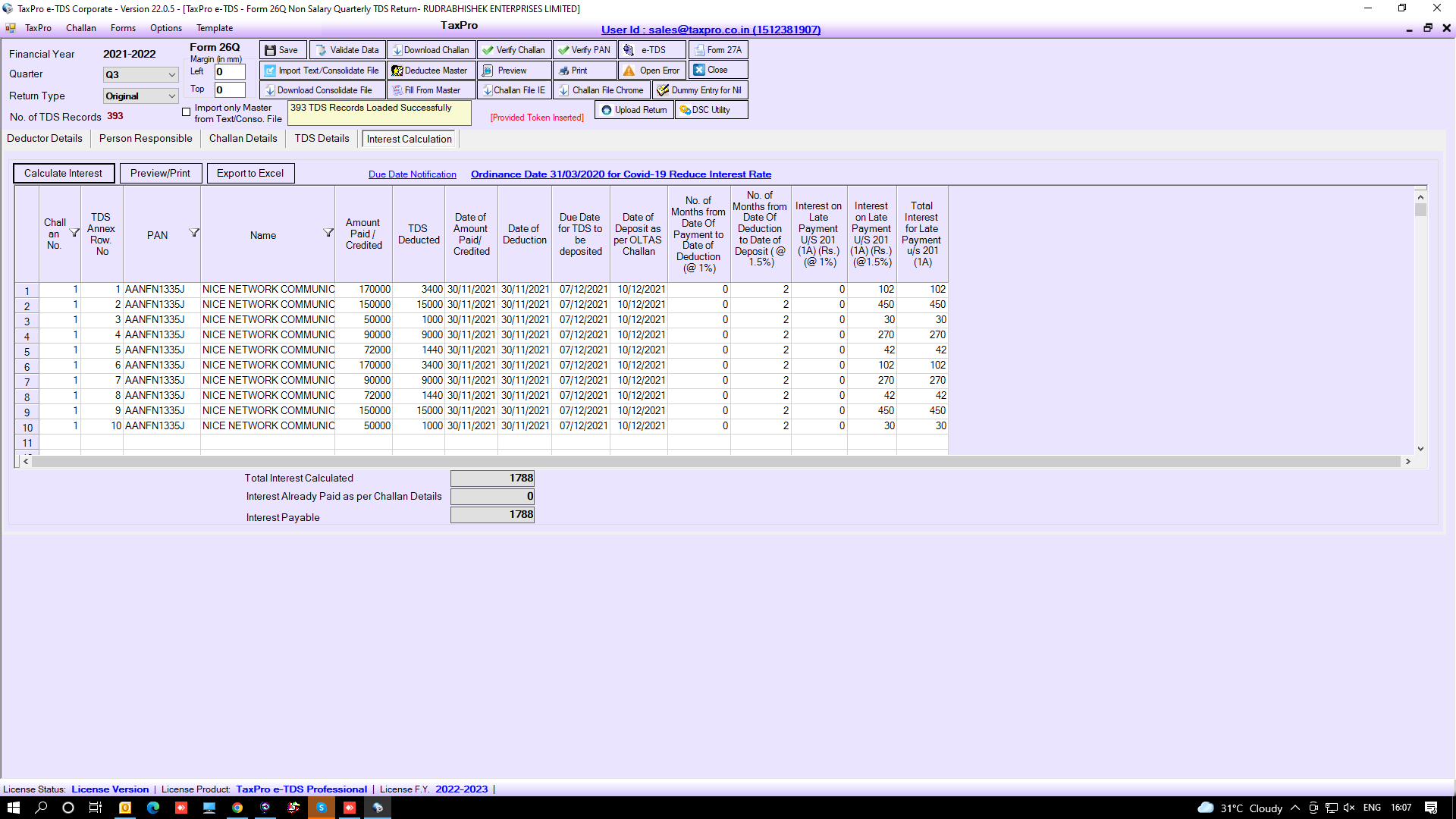

Interest on Late Payment Calculation¶

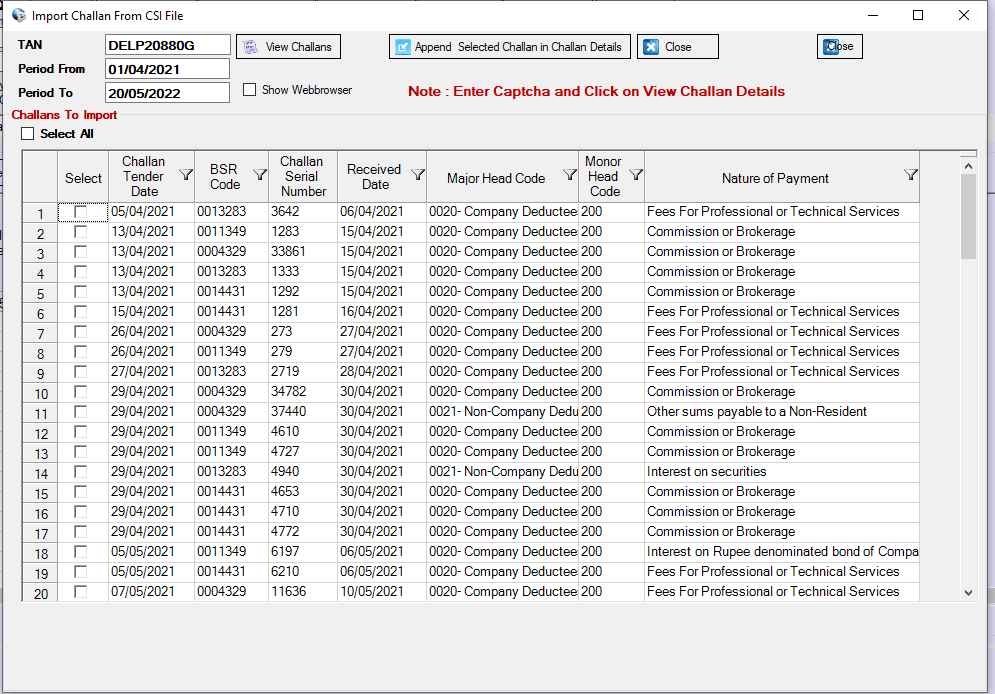

Import Challan Details from Department¶

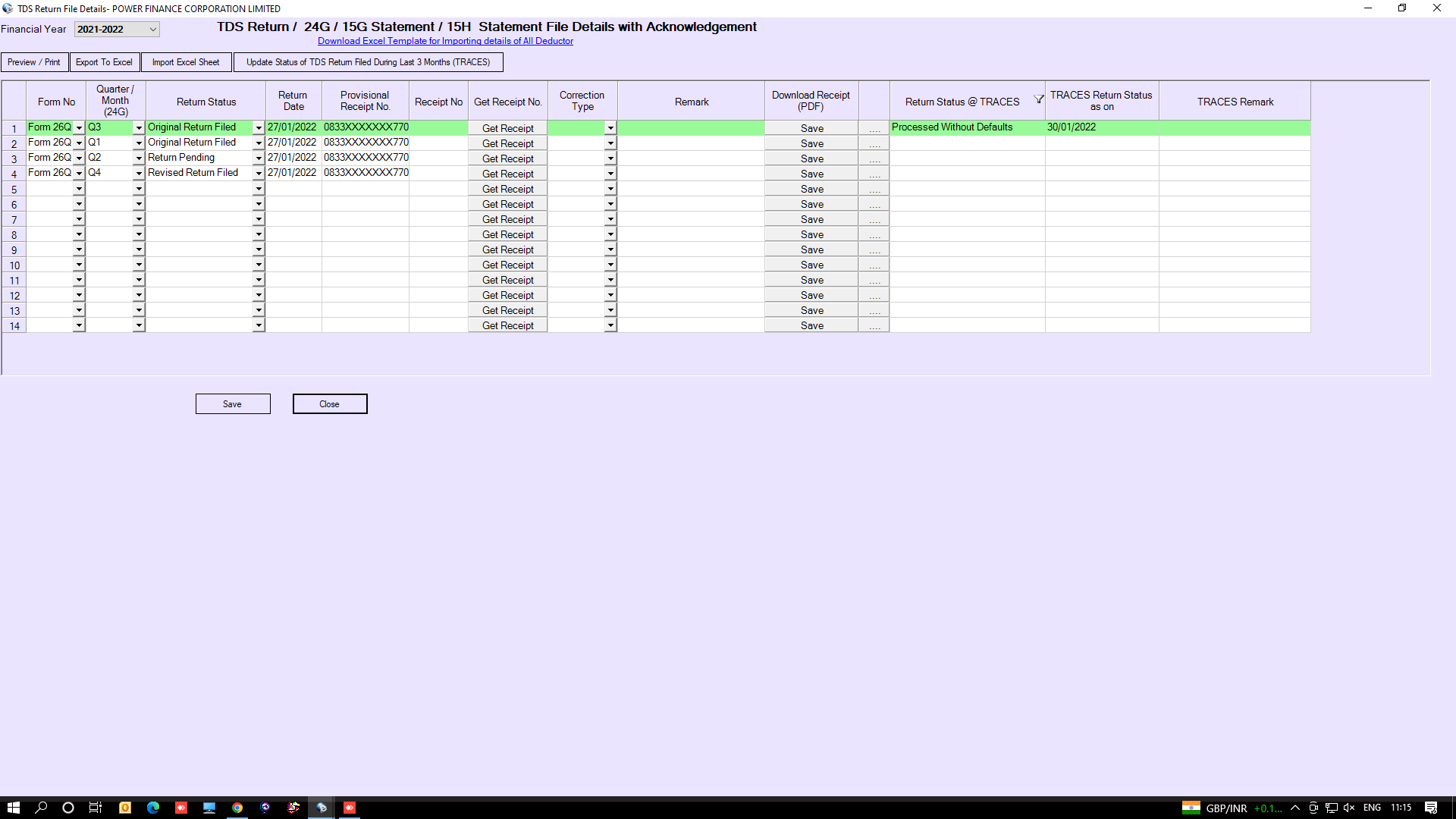

Return Filed Details¶

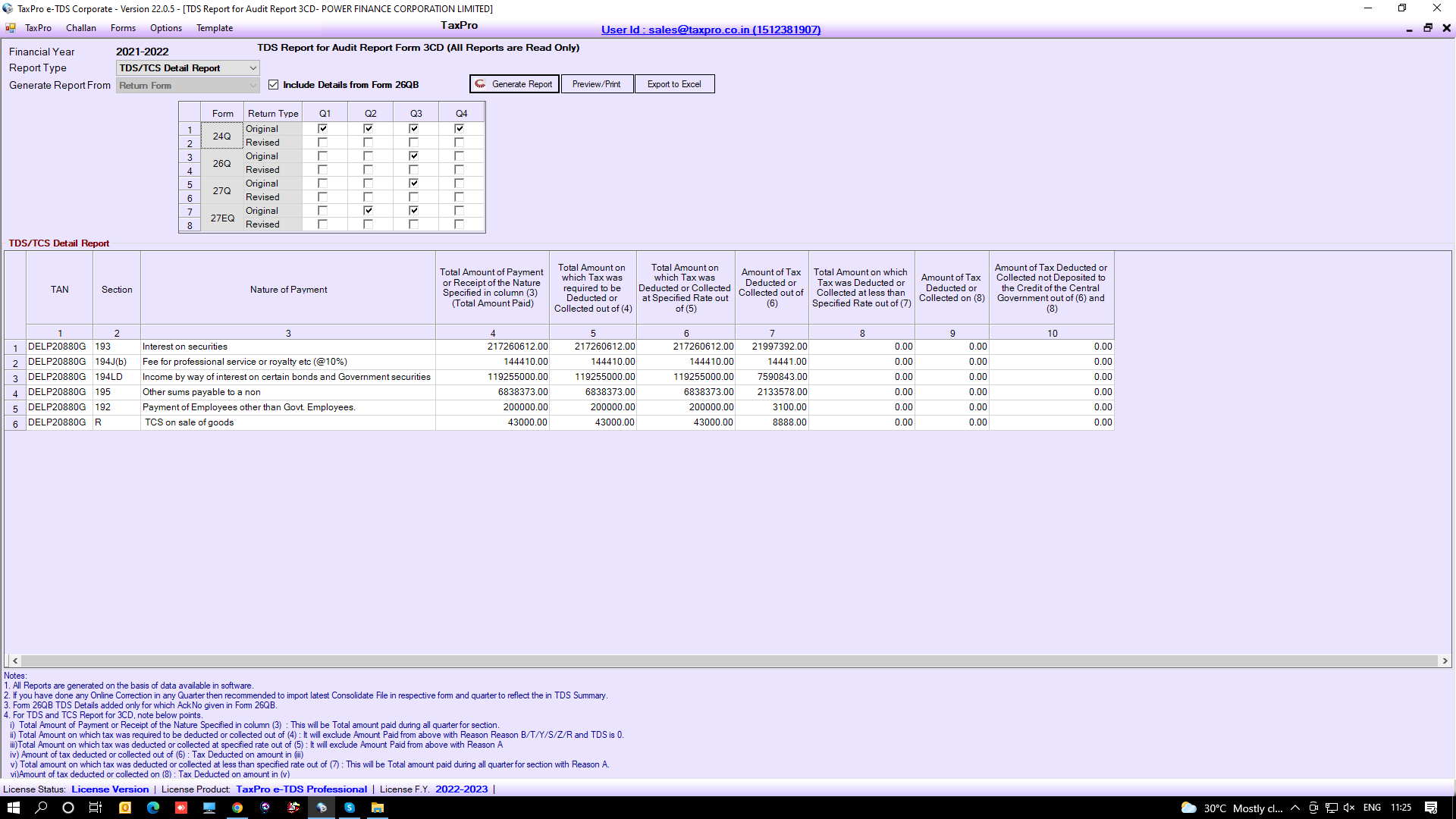

TDS Report for Form 3CD¶

TRACES Quick Links¶

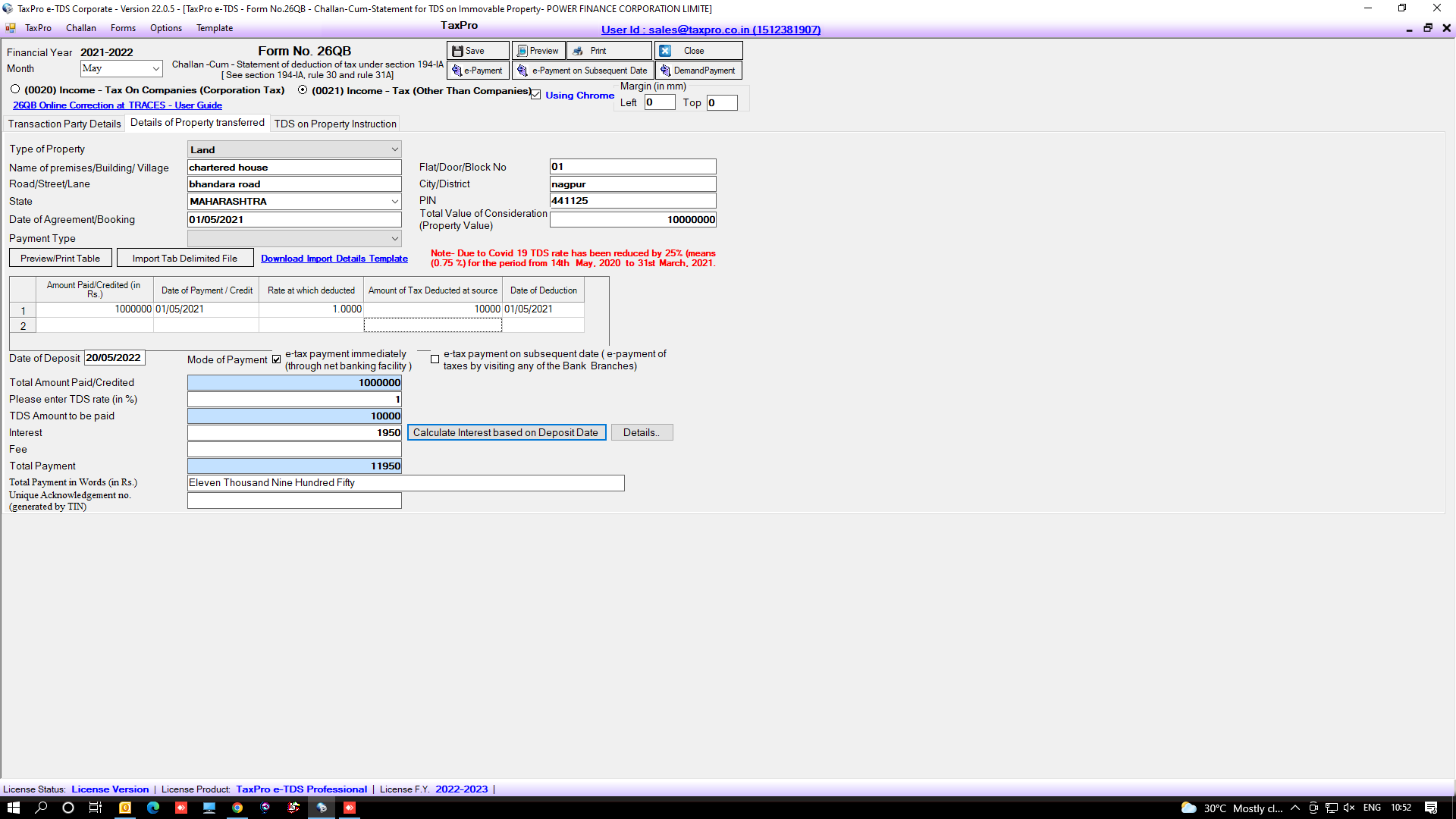

Form 26QB¶

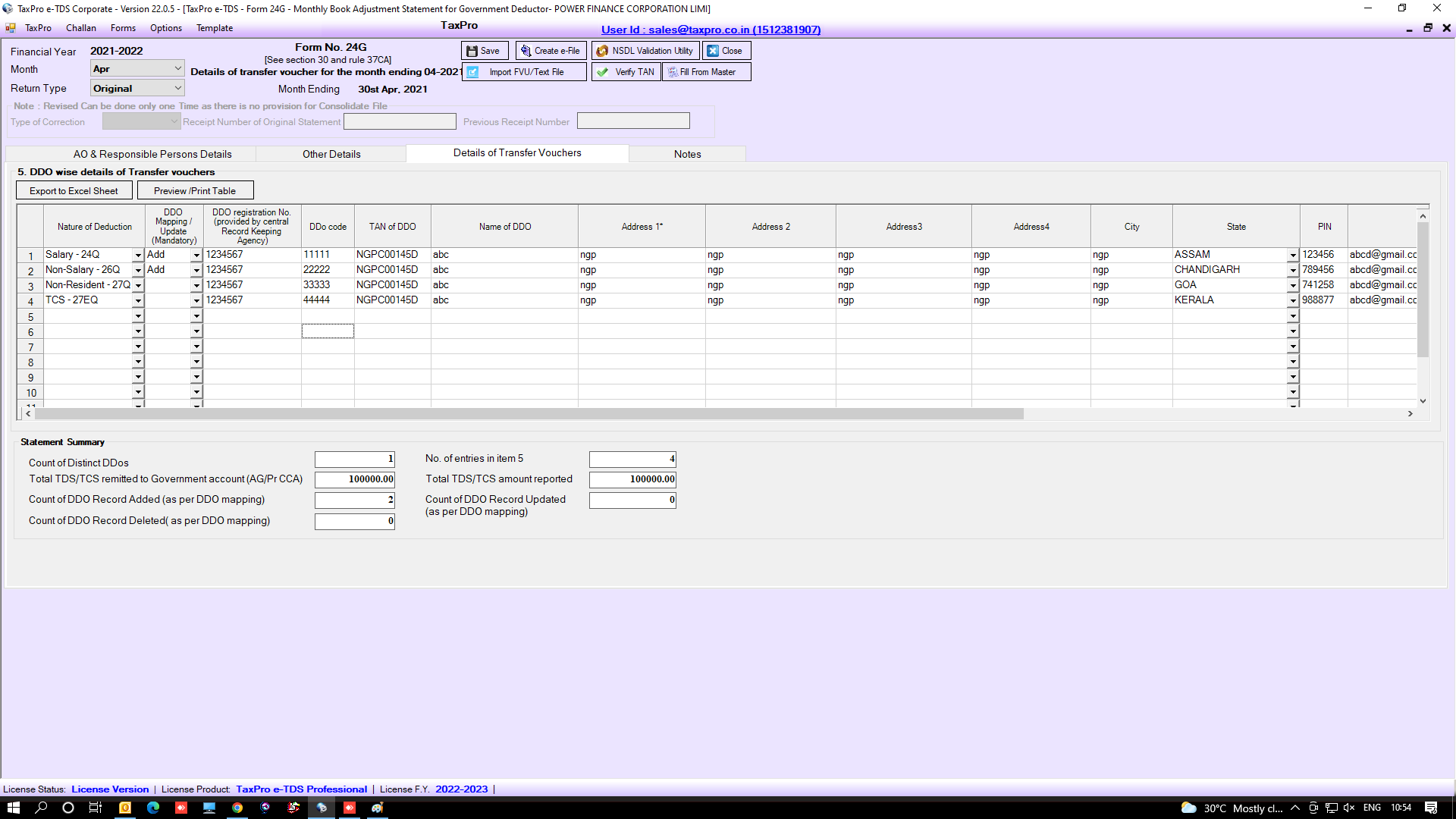

Form 24G¶

SFT Return¶