TaxPro IT User Guide¶

Computation¶

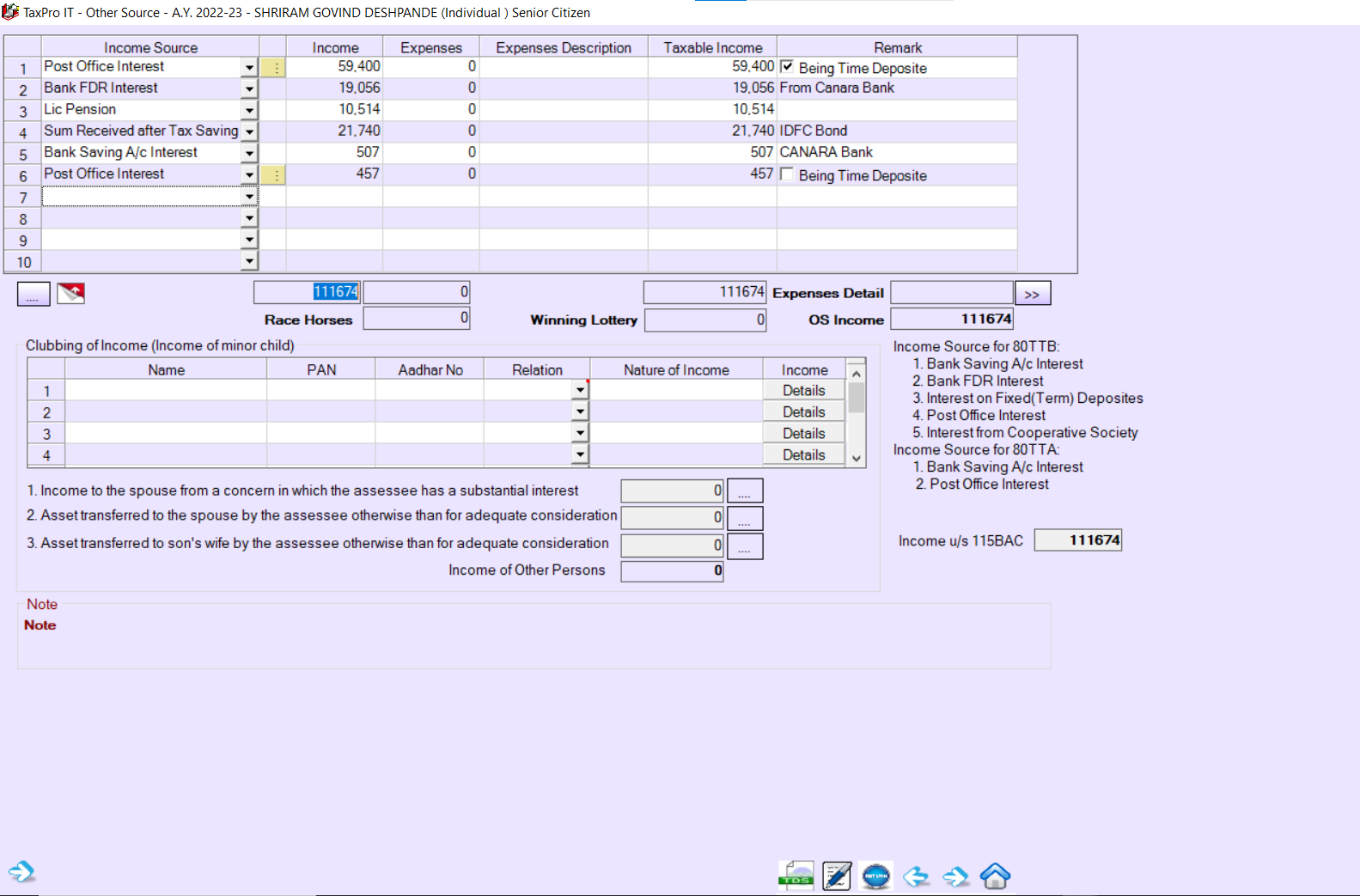

Income from Other Sources¶

Features Summary¶

Features Summary

- This screen has the Income from Other Sources table and Clubbing of income details.

- Income from other sources can be entered in Other Income details table

- Income Sources - Select the source of income from the list. Items keyed in by selecting “Other (Specify)” and Other Information, entered in last column, for that item will be remembered and will be made available in the drop down list when the screen is reopened.

- Income - Income amount.

- Expenses - Expenditure incurred if any. Locked if the income is exempt.

- Expenses Description - Description of the Expenses as to be printed in Statement of Income. Locked if the income is exempt.

- Taxable Income - Taxable Income for the item will be displayed in this field.

- Remark - Type the other information pertaining to the Income Source. For instance if ‘Bank FDR Interest’ is selected in Income Source field then, ‘from State Bank of India, Nagpur’ can be entered in this field. The taxable status of items entered by selecting “Other (Specify)” or items added by user, appearing below “Other (Specify)”, depends on the text entered in Other Information column. If the word “Exempt” appears in the phrase entered in Other Information field, the item will be treated as exempt else the item will be treated as wholly taxable.

- Takes care of exemption u/s 10(3) from the Winning income, 80TTA, 80TTB ,.. etc

- Customised Income Source List

- Auto Calculation of other source taxable income.

Clubbing of Income¶

Following incomes can be specified for clubbing of Income to assessee’s income:

- Minor’s Income

- Income to the spouse from a concern in which the assessee has a substantial interest

- Asset transferred to the spouse by the assessee otherwise than for adequate consideration

- Asset transferred to son’s wife by the assessee otherwise than for adequate consideration