TaxPro IT User Guide¶

Computation¶

Deduction and Set-off¶

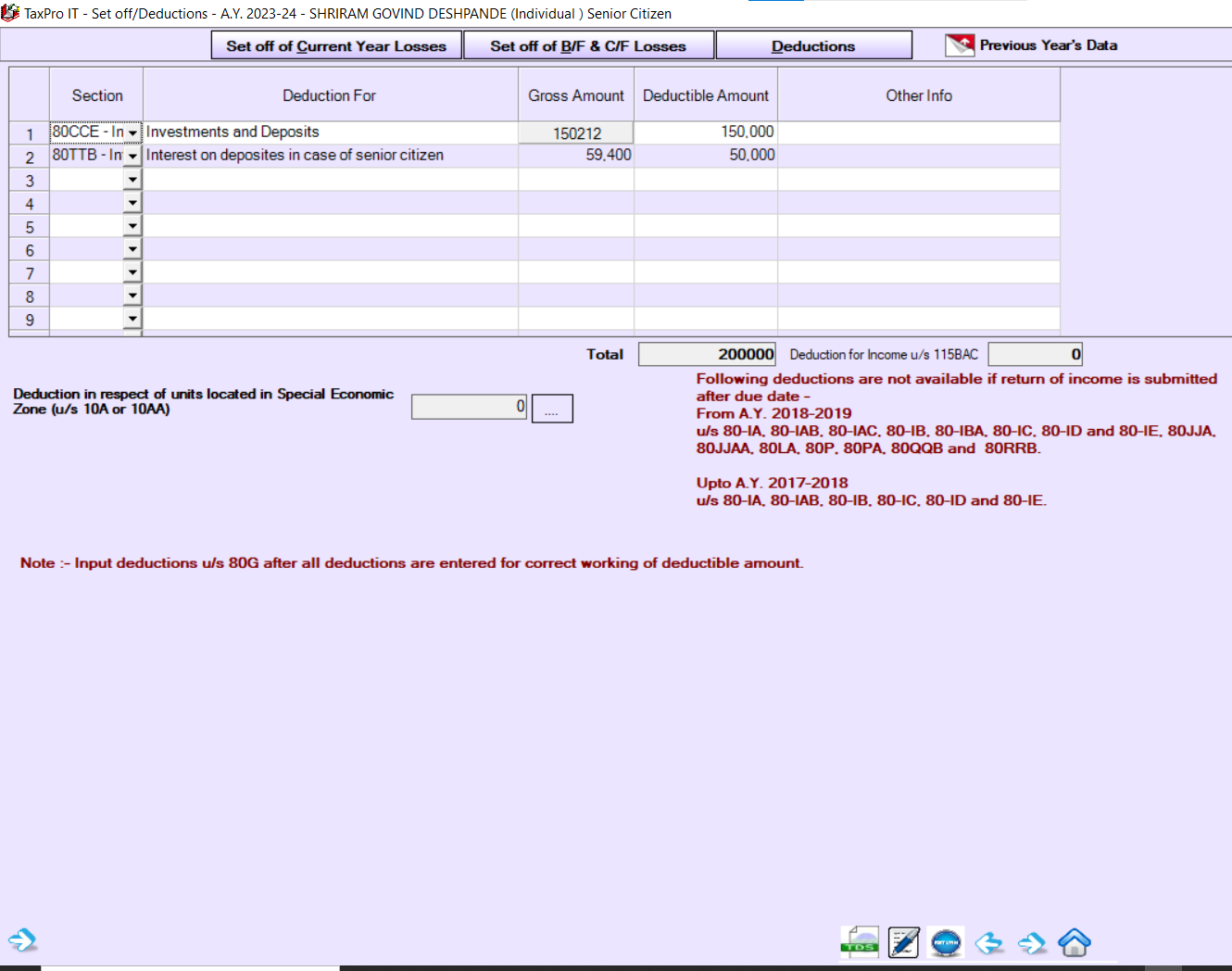

Deductions under Chap-VIA¶

Deductions under Chap-VIA

- Deductions to be claimed under chapter VIA can be entered in Deduction Details grid.

- Deductions u/s 80TTA, 80TTB automatically populated to deductions table as per the interest income details given in Income from Other Sources.

- For deduction u/s 80G Maximum Qualifying Amount will be auto calculated.

- Deduction details u/s 80C, 80CCC and 80CCD(1) can be provided under 80CCE Details

- Input deductions u/s 80G after all deductions are entered for correct working of deductible amount.

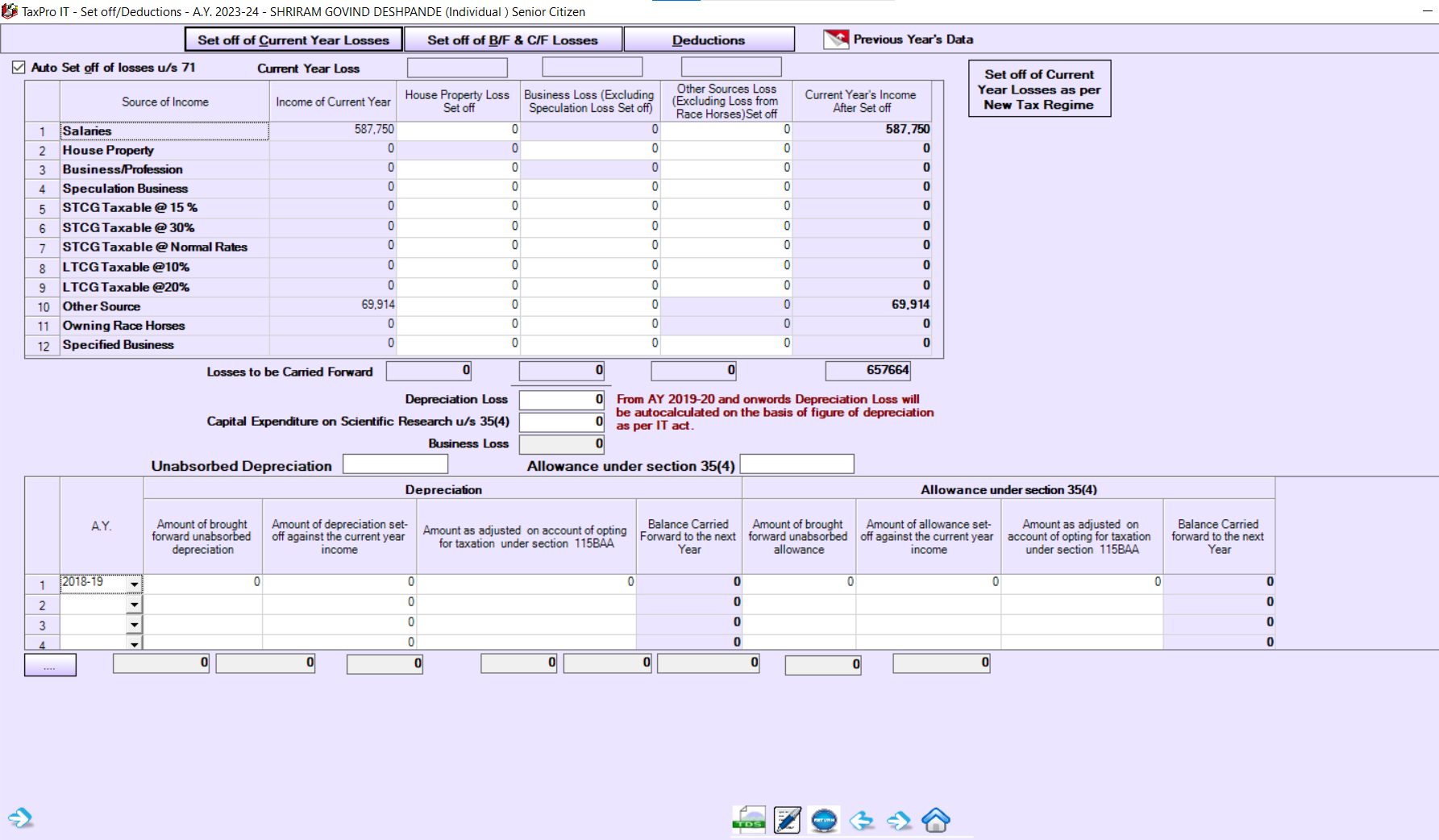

Set-off of Current Year Losses¶

Set-off of Current Year Losses

-

TaxPro Set-off engine sets-off current year losses as per the working presented in Set-off of current year losses worksheet on Set off of losses screen. The check box above this worksheet enables users to manually decide priorities of the set-off of current year losses. Removing tick on this check box opens the appropriate cells in worksheet for editing.

-

By default, TaxPro Set-off engine will set-off the losses from Other Sources (excluding losses from Owning Race Horses) first, since Other Sources losses are not allowed to carry forward to next years.

- Also, it takes care of setting-off losses from LTCG taxable at 20% and then, if applicable, will set-off losses from LTCG taxable at 10%.

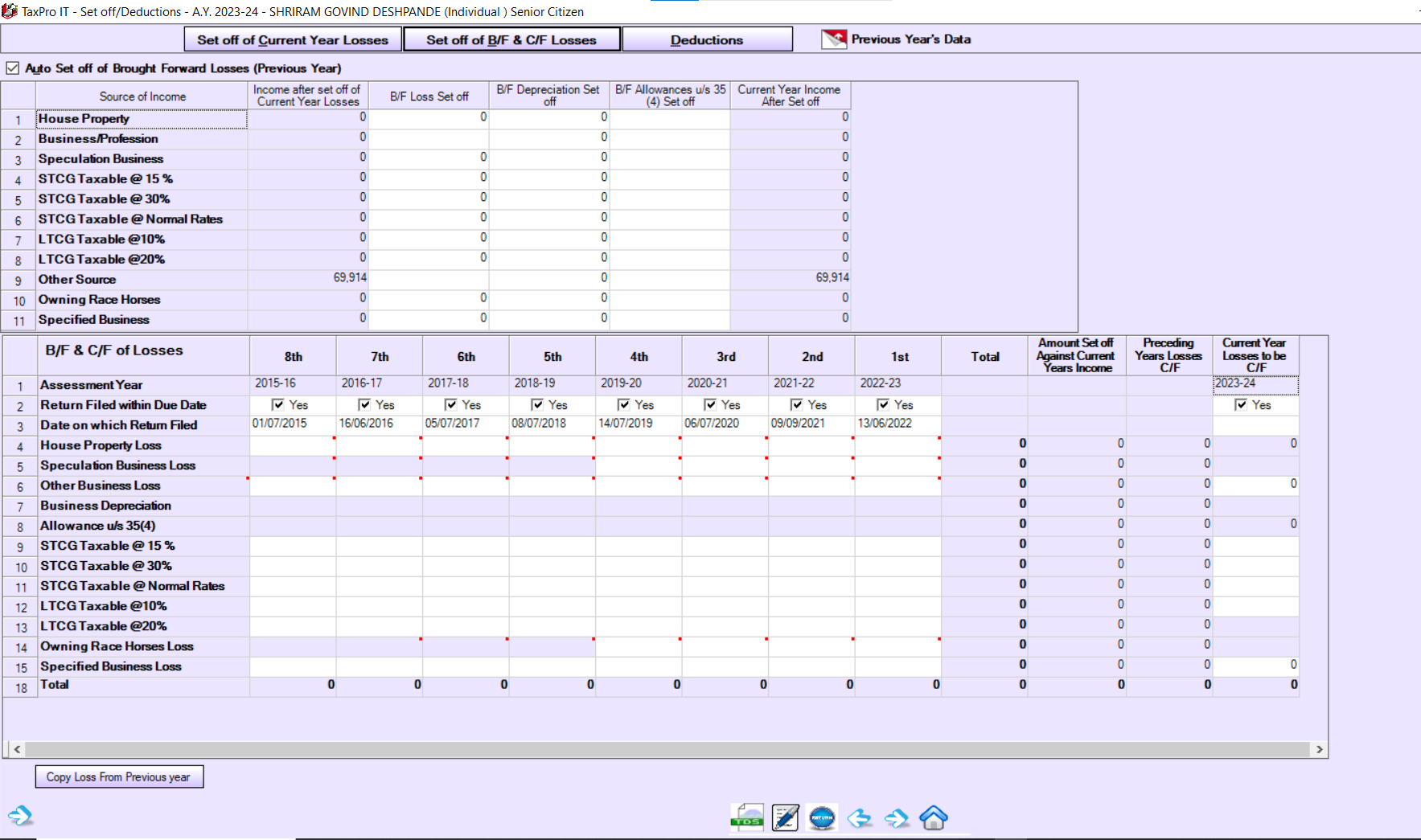

Set-off of Previous Losses¶

Set-off of Previous Losses

-

TaxPro Set-off engine sets-off losses brought forward from previous years (remembered by TaxPro) as per the working presented in Set-off of previous year losses worksheet on Set off of losses screen. The check box above this worksheet enables users to manually decide priorities of the set-off of previous year losses. Removing tick on this check box opens the appropriate cells in worksheet for editing. The unadjusted losses will be automatically carried forward to next year.

-

The worksheet will display Current year’s income after set-off of previous year losses, if any, which will be carried to Tax Details screen.

Carry Forward of Unabsorbed Losses¶

Carry Forward of Unabsorbed Losses

-

TaxPro Set-off engine sets-off losses brought forward from previous years as per working presented in B/F and C/F losses worksheet. The worksheet shows losses brought forward from previous eight years, as applicable to loss head. The worksheet also displays amount of loss under each head adjusted against current year’s income, unabsorbed losses from preceding years to be carried forward to next year and Current year losses to be carried forward.

-

The current year losses carried forward will automatically appear in this table in the column of respective AY, when computation of next AY will be started for the assessee.