TaxPro IT User Guide¶

Trust Details for ITR-7¶

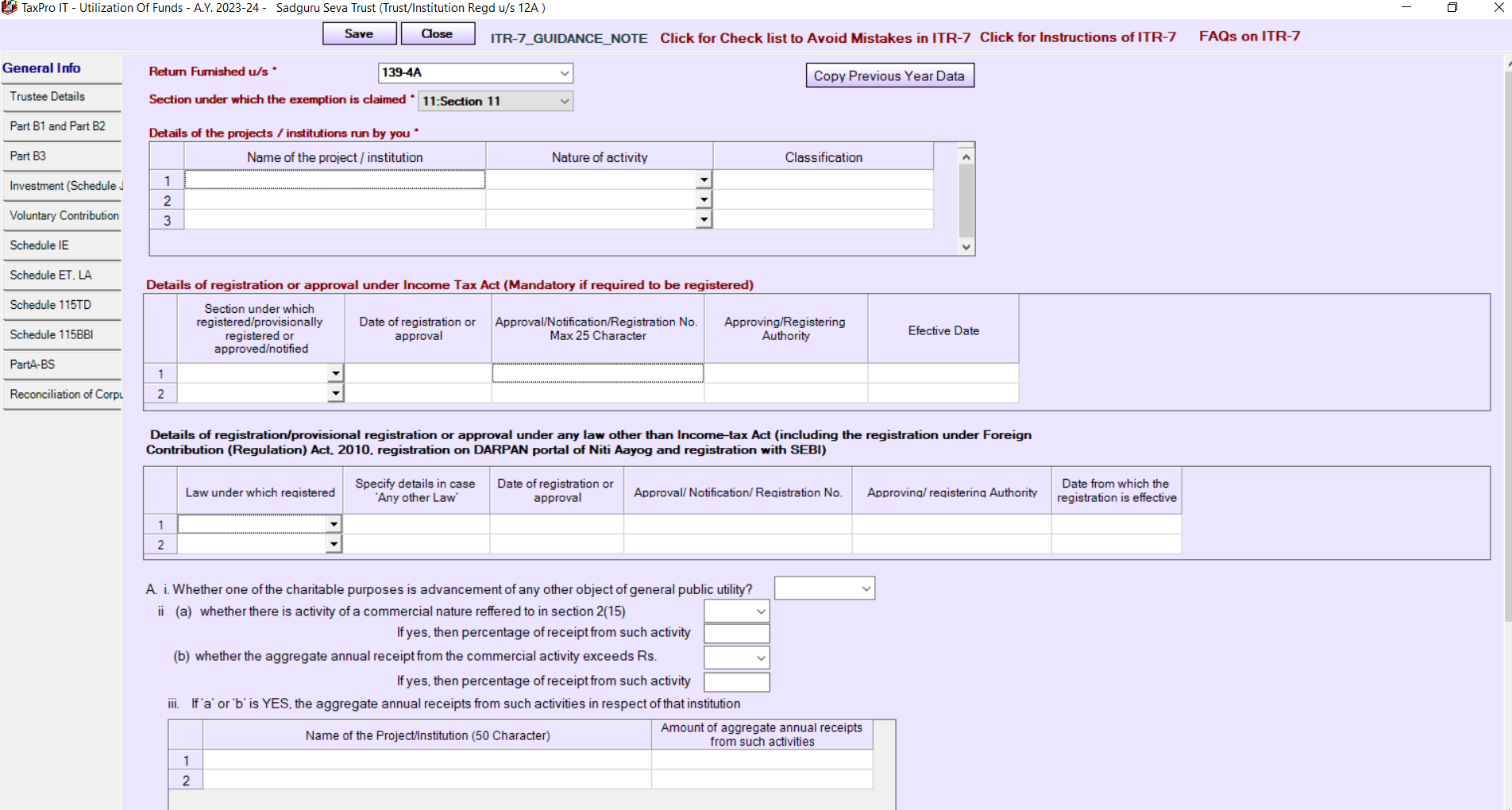

- You can provide Trust Details of various schedule for proper population of information in ITR-7.

How to provide Trust Details

- Click on F11 - Trust Other Info on Assessee Index Screen.

- Provide required information in General Info tab.

- Provide details in Trustee Details tab.

- Provide details in Part B1 and PartB2 tab for claiming exemtion u/s 11 and u/s 12.

- Provide details in Part B3 tab for provisions of 22nd proviso to section 10(23C) or Section 13(10).

- Provide required information in Investment Schedule J tab for funds and investments if registerd u/s 12A or 12AA or 12AB or approved u/s 10(23C)(iv).

- Provide required information in Schedule VC - Voluntary Contribution tab.

- Provide required information in Schedule IE tab for Income and Expenditure Statement.

- Provide required information in Schedule ET, Schedule LA, Schedule 115TD and Schedule 115BBI

- Provide details in PartA-BS - Balance Sheet.

- Provide required information in Renconciliation of Corpus.